You found your dream vacation cottage in the mountains and your offer of $78,000 was accepted. You plan to put 20% down and will roll the closing costs of $3,500 into the mortgage. Congratulations, your 15 year mortgage has been approved at an interest rate of 4.125%. (You must use the attached Excel loan amortization schedule).

1. How much are you financing?

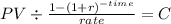

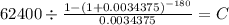

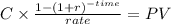

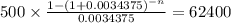

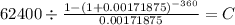

2. How much are your monthly mortgage payments?

3. How much will you pay in total interest? If, before you began paying the loan: You decided to round your payment up to the nearest $100. How much additional would you pay?

4. How much interest would paying the additional amount save you over the life of the loan?

5. Does this change the total number of payments to satisfy the loan? If so, by how many? Instead of paying the additional, you decide to pay by-weekly.

6. What are your payments? Rather than paying additional what if: You decided to pay bi-weekly payments.

7. How much less will you pay over the life of the loan?

Answers: 2

Another question on Business

Business, 22.06.2019 11:50

What is marketing’s contribution to the new product development team? a. technical expertise needed to translate designs into an actual product/service. b. deep customer insight that leads to product ideas. c. ability to assess financial viability d. feedback on design as well as how customers will actually use the product e. technical expertise needed to translate concepts into product/service designs.

Answers: 2

Business, 22.06.2019 18:50

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

Business, 23.06.2019 02:30

Drag the tiles to the correct boxes to complete the pairs. match the scenarios with terms related to financial aid. entrance counseling fafsa financial need megan is planning to pursue an undergraduate degree in chemistry. but since her father lost his job five years ago, the family had been unable to save up enough for megan's education. arrowright kunal recently learned that he is going to receive a student loan. now he needs to attend a session in which he will learn the how the loan process works, as well as his responsibilities as a borrower. arrowright josie created an fsa id and completed a long application form online. the form asked for a lot of financial details about josie and her family. arrowright

Answers: 1

You know the right answer?

You found your dream vacation cottage in the mountains and your offer of $78,000 was accepted. You p...

Questions

Social Studies, 04.08.2019 20:00

History, 04.08.2019 20:00

History, 04.08.2019 20:00

English, 04.08.2019 20:00

Mathematics, 04.08.2019 20:00

Mathematics, 04.08.2019 20:00

Spanish, 04.08.2019 20:00

History, 04.08.2019 20:00

History, 04.08.2019 20:00

Chemistry, 04.08.2019 20:00

Arts, 04.08.2019 20:00

Biology, 04.08.2019 20:00