Business, 26.06.2020 15:01 Gghbhgy4809

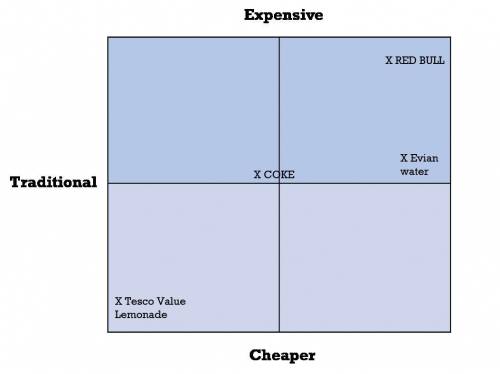

MINI CASE STUDY - 6 marks In years gone by the soft drinks market was dominated by fizz, with Coca-Cola as the leading brand. Within UK sales of over £1 billion a year, Coke is stil massive, but in 2015 and 2016 sale fell. In recent years the big winners have been: Main water brands, e. g. Evian Energy drinks e. g. Red Bull/Monster Adult-focused drinks, such as Fever-Tree Drinks with a healthy ‘vibe’ such as Innocent Coconut water. Oddly, though in the UK no one has quite managed the trick pulled off by Oasis in America; a big selling, non-fizzy drink for adults. Answer the below questions: Q1. Outline one possible reasons why UK sale of Coca-Cola are declining (2 marks) Q2. a) Outline where you think Coconut Water is positioned on the soft drinks market map. (2 marks) b) Outline one benefit of that positioning for a business such as Innocent drinks. (2 marks)

Answers: 2

Another question on Business

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 23.06.2019 01:40

The new york times (nov. 30, 1993) reported that “the inability of opec to agree last week to cut production has sent the oil market into turmoil . . [leading to] the lowest price for domestic crude oil since june 1990.” why were the members of opec trying to agree to cut production? so they could save more oil for future consumption so they could lower the price so they could raise the price why do you suppose opec was unable to agree on cutting production? because each country has a different production capacity because each country experiences different production costs because each country has an incentive to cheat on any agreement the newspaper also noted opec’s view “that producing nations outside the organization, like norway and britain, should do their share and cut production.” what does the phrase “do their share” suggest about opec’s desired relationship with norway and britain? opec would like norway and britain to keep their production levels high. opec would like norway and britain to act competitively. opec would like norway and britain to join the cartel.

Answers: 2

Business, 23.06.2019 18:40

Joe needs to see the slide transitions and animations he has applied to his slide in a large view. which presentation view should he use? in which tab would joe find the animations option to make further changes, if any?

Answers: 1

You know the right answer?

MINI CASE STUDY - 6 marks In years gone by the soft drinks market was dominated by fizz, with Coca-C...

Questions

Biology, 26.09.2019 03:30

Mathematics, 26.09.2019 03:30

Biology, 26.09.2019 03:30

Mathematics, 26.09.2019 03:30

Mathematics, 26.09.2019 03:30

English, 26.09.2019 03:30

History, 26.09.2019 03:30

Mathematics, 26.09.2019 03:30

Mathematics, 26.09.2019 03:30

History, 26.09.2019 03:30

English, 26.09.2019 03:30