Business, 28.06.2020 06:01 krystalsanabria83

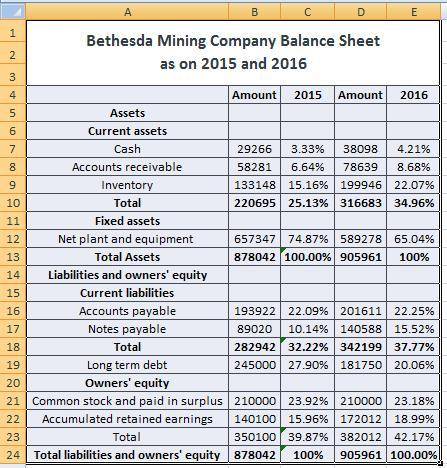

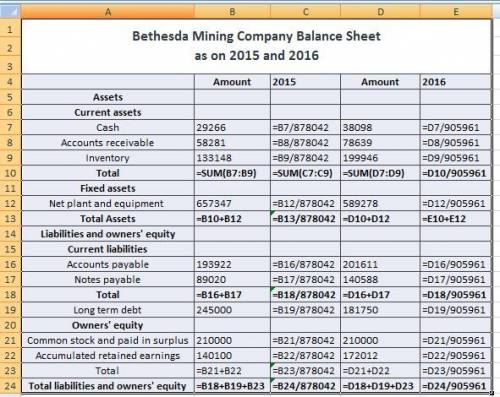

Bethesda Mining Company reports the following balance sheet information for 2015 and 2016.

Prepare the 2015 and 2016 common-size balance sheets for Bethesda Mining. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

BETHESDA MINING COMPANY

Balance Sheets as of December 31, 2015 and 2016

2015 2016 2015 2016

Assets Liabilities and Owners’ Equity

Current assets Current liabilities

Cash $ 29,266 % $ 38,098 % Accounts payable $ 193,922 % $ 201,611 %

Accounts receivable 58,281 % 78,639 % Notes payable 89,020 % 140,588 %

Inventory 133,148 % 199,946 % Total $ 282,942 % $ 342,199 %

Total $ 220,695 % $ 316,683 % Long-term debt $ 245,000 % $ 181,750 %

Owners’ equity

Common stock and paid-in surplus $ 210,000 % $ 210,000 %

Fixed assets Accumulated retained earnings 140,100 % 172,012 %

Net plant and equipment $ 657,347 % $ 589,278 % Total $ 350,100 % $ 382,012 %

Total assets $ 878,042 % $ 905,961 % Total liabilities and owners’ equity $ 878,042 % $ 905,961 %

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Astock with a beta of 0.6 has an expected rate of return of 13%. if the market return this year turns out to be 10 percentage points below expectations, what is your best guess as to the rate of return on the stock? (do not round intermediate calculations. enter your answer as a percent rounded to 1 decimal place.)

Answers: 2

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Business, 22.06.2019 19:40

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

You know the right answer?

Bethesda Mining Company reports the following balance sheet information for 2015 and 2016.

Prepare...

Questions

Mathematics, 12.02.2021 08:20

History, 12.02.2021 08:20

Mathematics, 12.02.2021 08:20

Biology, 12.02.2021 08:20

History, 12.02.2021 08:20

English, 12.02.2021 08:20

Mathematics, 12.02.2021 08:20

History, 12.02.2021 08:20

Mathematics, 12.02.2021 08:20