Business, 01.07.2020 15:01 strodersage

Suppose savers either buy bonds or make deposits in savings accounts at banks. Initially, the interest income earned on bonds or deposits is taxed at a rate of 20%. Now suppose there is a decrease in the tax rate on interest income, from 20% to 15%.

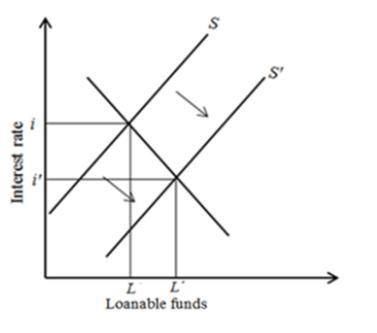

This change in the tax treatment of saving causes the equilibrium interest rate in the market for loanable funds to (Fall/rise) and the level of investment spending to (decrease/increase) .

An investment tax credit effectively lowers the tax bill of any firm that purchases new capital in the relevant time period. Suppose the government implements a new investment tax credit.

Shift the appropriate curve on the graph to reflect this change.

The implementation of the new tax credit causes the interest rate to (fall/rise)and the level of investment to(fall/rise) .

Initially, the government's budget is balanced, then the government responds to the conclusion of a war by significantly reducing defense spending without changing taxes.

This change in spending causes the government to run a budget(deficit/surplus) which(increases/decreases)national saving.

Shift the appropriate curve on the graph to reflect this change.

This causes the interest rate to ___(fall/rise)(increasing/crowding out)the level of investment spending.

Answers: 3

Another question on Business

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 11:40

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 16:40

An electronics store is running a promotion where for every video game purchased, the customer receives a coupon upon checkout to purchase a second game at a 50% discount. the coupons expire in one year. the store normally recognized a gross profit margin of 40% of the selling price on video games. how would the store account for a purchase using the discount coupon?

Answers: 3

You know the right answer?

Suppose savers either buy bonds or make deposits in savings accounts at banks. Initially, the intere...

Questions

Social Studies, 19.09.2021 03:40

History, 19.09.2021 03:50

Advanced Placement (AP), 19.09.2021 03:50

Mathematics, 19.09.2021 03:50

Mathematics, 19.09.2021 03:50

English, 19.09.2021 03:50

Mathematics, 19.09.2021 03:50

Mathematics, 19.09.2021 03:50

Mathematics, 19.09.2021 03:50

Mathematics, 19.09.2021 03:50

History, 19.09.2021 03:50