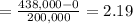

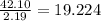

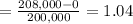

Stilley Corporation had earnings after taxes of $438,000 in 20X2 with 200,000 shares outstanding. The stock price was $42.10. In 20X3, earnings after taxes declined to $208,000 with the same 200,000 shares outstanding. The stock price declined to $28.30. a. Compute earnings per share and the P/E ratio for 20X2. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) b. Compute earnings per share and the P/E ratio for 20X3. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)\

Answers: 3

Another question on Business

Business, 21.06.2019 19:40

Which of the following actions is most likely to result in a decrease in the money supply? a. the required reserve ratio for banks is decreased. b. the discount rate on overnight loans is lowered. c. the federal reserve bank buys treasury bonds. d. the government sells a new batch of treasury bonds. 2b2t

Answers: 1

Business, 22.06.2019 20:20

Gamegirl inc., has the following transactions during august. august 6 sold 76 handheld game devices for $230 each to ds unlimited on account, terms 2/10, net 60. the cost of the 76 game devices sold, was $210 each. august 10 ds unlimited returned six game devices purchased on 6th august since they were defective. august 14 received full amount due from ds unlimited. required: prepare the transactions for gamegirl, inc., assuming the company uses a perpetual inventory syste

Answers: 2

Business, 22.06.2019 20:50

Which of the following is an example of a monetary policy? a. the government requires credit card companies to protect customers' privacy. b. the government restricts the amount of money that banks can lend. c. the government lowers taxes and increases spending. d. the government pays for repairing damage from a natural disaster.

Answers: 1

Business, 23.06.2019 00:40

In 2017, "a public university was awarded a federal reimbursement grant" of $18 million to carry out research. of this, $12 million was intended to cover direct costs and $6 million to cover overhead. in a particular year, the university incurred $4 million in allowable direct costs and received $3.4 million from the federal government. it expected to incur the remaining costs and collect the remaining balance in 2018. for 2017 it should recognize revenues from the grant of

Answers: 3

You know the right answer?

Stilley Corporation had earnings after taxes of $438,000 in 20X2 with 200,000 shares outstanding. Th...

Questions

History, 05.03.2021 16:40

History, 05.03.2021 16:40

Mathematics, 05.03.2021 16:40

Biology, 05.03.2021 16:40

Chemistry, 05.03.2021 16:40

Mathematics, 05.03.2021 16:40

History, 05.03.2021 16:40

Biology, 05.03.2021 16:40

Mathematics, 05.03.2021 16:40

Mathematics, 05.03.2021 16:40

Mathematics, 05.03.2021 16:40