Business, 01.07.2020 17:01 cedarclark9534

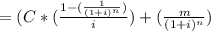

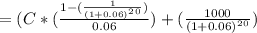

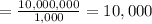

CMS Corporation's balance sheet as of today is as follows: Long-term debt (bonds, at par) $10,000,000 Preferred stock 2,000,000 Common stock ($10 par) 10,000,000 Retained earnings 4,000,000 Total debt and equity $26,000,000 The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt

Answers: 2

Another question on Business

Business, 22.06.2019 07:30

Which of the following best describes why you need to establish goals for your program?

Answers: 3

Business, 22.06.2019 12:30

Provide an example of open-ended credit account that caroline has. caroline blue's credit report worksheet.

Answers: 1

Business, 22.06.2019 13:10

bradford, inc., expects to sell 9,000 ceramic vases for $21 each. direct materials costs are $3, direct manufacturing labor is $12, and manufacturing overhead is $3 per vase. the following inventory levels apply to 2019: beginning inventory ending inventory direct materials 3,000 units 3,000 units work-in-process inventory 0 units 0 units finished goods inventory 300 units 500 units what are the 2019 budgeted production costs for direct materials, direct manufacturing labor, and manufacturing overhead, respectively?

Answers: 2

Business, 22.06.2019 16:30

Why are there so many types of diversion programs for juveniles

Answers: 2

You know the right answer?

CMS Corporation's balance sheet as of today is as follows: Long-term debt (bonds, at par) $10,000,00...

Questions

Biology, 13.01.2020 08:31

History, 13.01.2020 08:31

History, 13.01.2020 08:31

Mathematics, 13.01.2020 08:31

Mathematics, 13.01.2020 08:31

History, 13.01.2020 08:31

English, 13.01.2020 08:31

Mathematics, 13.01.2020 09:31

Mathematics, 13.01.2020 09:31

English, 13.01.2020 09:31

Mathematics, 13.01.2020 09:31