Business, 05.07.2020 16:01 alliemeade1

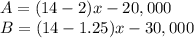

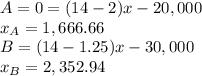

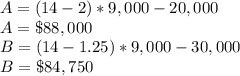

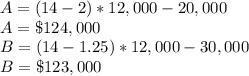

Janelle Heinke, the owner of Ha'Peppas!, is considering a new oven in which to bake the firm's signature dish, vegetarian pizza. Oven type A can handle 20 pizzas an hour. The fixed costs associated with oven A are $20,000 and the variable costs are $2.00 per pizza. Oven B is larger and can handle 40 pizzas an hour. The fixed costs associated with oven B are $30,000 and the variable costs are $1.25 per pizza. The pizzas sell for $14 each.

a) What is the break-even point for each oven?

b) If the owner expects to sell 9,000 pizzas, which oven should she purchase?

c) If the owner expects to sell 12,000 pizzas, which oven should she purchase?

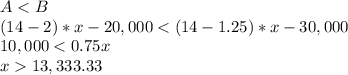

d) At what volume should Janelle switch ovens?

Answers: 2

Another question on Business

Business, 22.06.2019 11:20

In 2000, campbell soup company launched an ad campaign that showed prepubescent boys offering soup to prepubescent girls. the girls declined because they were concerned about their calorie intake. the boys explained that “lots of campbell’s soups are low in calories,” which made them ok for the girls to eat. the ads were pulled after parents expressed concern. why were parents worried? i

Answers: 2

Business, 22.06.2019 13:40

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

Business, 22.06.2019 20:30

You are in the market for a new refrigerator for your company’s lounge, and you have narrowed the search down to two models. the energy efficient model sells for $700 and will save you $45 at the end of each of the next five years in electricity costs. the standard model has features similar to the energy efficient model but provides no future saving in electricity costs. it is priced at only $500. assuming your opportunity cost of funds is 6 percent, which refrigerator should you purchase

Answers: 3

Business, 22.06.2019 22:00

You wish to retire in 13 years, at which time you want to have accumulated enough money to receive an annual annuity of $23,000 for 18 years after retirement. during the period before retirement you can earn 9 percent annually, while after retirement you can earn 11 percent on your money. what annual contributions to the retirement fund will allow you to receive the $23,000 annuity? use appendix c and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

Answers: 1

You know the right answer?

Janelle Heinke, the owner of Ha'Peppas!, is considering a new oven in which to bake the firm's signa...

Questions

Social Studies, 04.11.2020 19:50

Computers and Technology, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

English, 04.11.2020 19:50

Biology, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50

Mathematics, 04.11.2020 19:50