Business, 05.07.2020 16:01 kieran1982

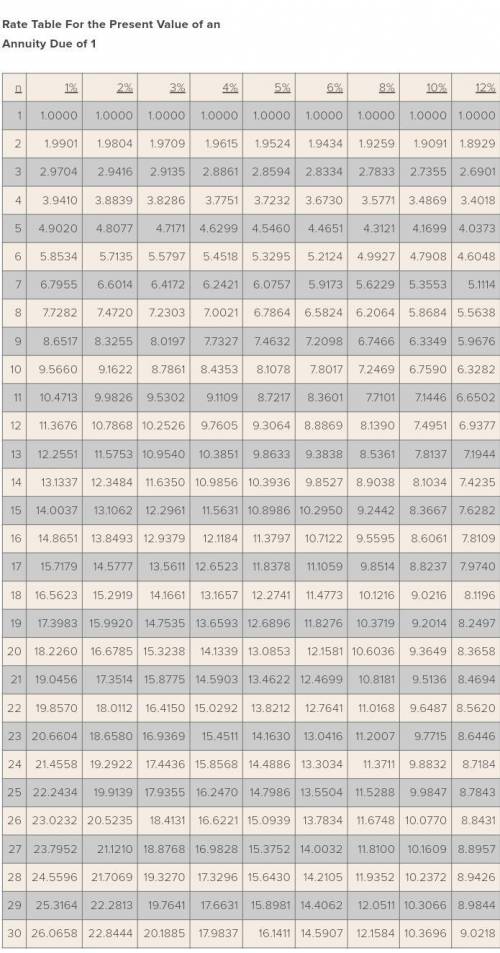

On January 1, 2018, Jasperse Corporation leased equipment under a finance lease designed to earn the lessor a 12% rate of return for providing long-term financing. The lease agreement specified ten annual payments of $60,000 beginning January 1, and each December 31 thereafter through 2026. A 10-year service agreement was scheduled to provide maintenance of the equipment as required for a fee of $4,500 per year. Insurance premiums of $3,500 annually are related to the equipment. Both amounts were to be paid by the lessor and lease payments reflect both expenditures. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

At what amount will Jasperse record a right-of-use asset?

PV factors based on

Table or Calculator function:PVAD of $1

Lease Payment

n =10

i =12%

Right-of-use asset

Answers: 3

Another question on Business

Business, 22.06.2019 03:00

How could brian, who doesn't want his car insurance premiums to increase, show he poses a low risk to his insurance company? a: drive safely to avoid accidents and traffic citations b: wash and wax his car regularly to keep it clean c: allow unlicensed drivers to drive carelessly in his car d: incur driver's license points from breaking driving laws

Answers: 1

Business, 22.06.2019 21:00

You have $5,300 to deposit. regency bank offers 6 percent per year compounded monthly (.5 percent per month), while king bank offers 6 percent but will only compounded annually. how much will your investment be worth in 17 years at each bank

Answers: 3

Business, 23.06.2019 00:50

Alpine west, inc., operates a downhill ski area near lake tahoe, california. an all-day, adult ticket can be purchased for $55. adult customers also can purchase a season pass that entitles the pass holder to ski any day during the season, which typically runs from december 1 through april 30. the season pass is nontransferable, and the $450 price is nonrefundable. alpine expects its season pass holders to use their passes equally throughout the season. the company’s fiscal year ends on december 31. on november 6, 2009, jake lawson purchased a season ticket. required: 1. when should alpine west recognize revenue from the sale of its season passes? 2. prepare the appropriate journal entries that alpine would record on november 6 and december 31. 3. what will be included in the 2009 income statement and 2009 balance sheet related to the sale of the season pass to jake lawson?

Answers: 3

Business, 23.06.2019 07:40

In the short-run, marginal costs are equal to the change in variable costs as output changes. ( mc = change in variable cost / change in quantity) assume that capital is fixed in the short-run. (a) start with the equation for marginal cost and derive an equation that relates marginal cost of production to the cost and productivity of labor. (b) draw a standard looking short-run marginal cost curve and use the equation you derived to explain its shape.

Answers: 2

You know the right answer?

On January 1, 2018, Jasperse Corporation leased equipment under a finance lease designed to earn the...

Questions

Mathematics, 21.05.2020 20:00

Mathematics, 21.05.2020 20:00

Mathematics, 21.05.2020 20:00

Social Studies, 21.05.2020 20:00

Mathematics, 21.05.2020 20:00

Mathematics, 21.05.2020 20:00

History, 21.05.2020 20:00

Mathematics, 21.05.2020 20:00