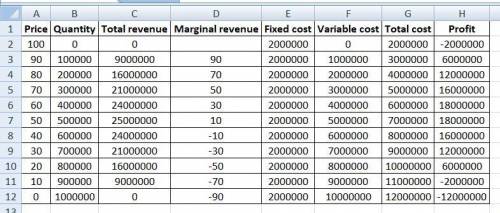

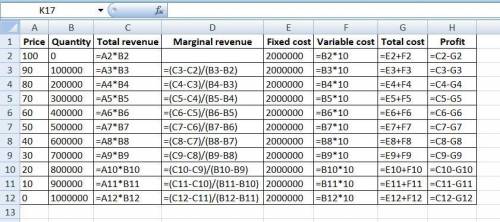

A publisher faces the following demand schedule for the next novel from one of its popular authors:

Price Quantity Demanded

(Dollars) (Copies)

100 0

90 100,000

80 200,000

70 300,000

60 400,000

50 500,000

40 600,000

30 700,000

20 800,000

10 900,000

0 1,000,000

The author is paid $2 million to write the novel, and the marginal cost of publishing the novel is a constant $10 per copy.

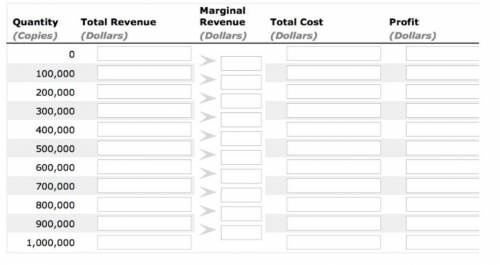

Complete the second, fourth, and fifth columns of the following table by computing total revenue, total cost, and profit at each quantity.

Quantity Total Revenue Marginal Revenue Total Cost Profit

(Novels) (Dollars) (Dollars) (Dollars) (Dollars)

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

Answers: 2

Another question on Business

Business, 22.06.2019 05:40

Grant, inc., acquired 30% of south co.’s voting stock for $200,000 on january 2, year 1, and did not elect the fair value option. the price equaled the carrying amount and the fair value of the interest purchased in south’s net assets. grant’s 30% interest in south gave grant the ability to exercise significant influence over south’s operating and financial policies. during year 1, south earned $80,000 and paid dividends of $50,000. south reported earnings of $100,000 for the 6 months ended june 30, year 2, and $200,000 for the year ended december 31, year 2. on july 1, year 2, grant sold half of its stock in south for $150,000 cash. south paid dividends of $60,000 on october 1, year 2. before income taxes, what amount should grant include in its year 1 income statement as a result of the investment?

Answers: 1

Business, 22.06.2019 07:30

Which two of the following are benefits of consumer programs

Answers: 1

Business, 22.06.2019 19:00

Describe how to write a main idea expressed as a bottom-line statement

Answers: 3

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

You know the right answer?

A publisher faces the following demand schedule for the next novel from one of its popular authors:...

Questions

Mathematics, 21.08.2019 18:20

Biology, 21.08.2019 18:20

History, 21.08.2019 18:20

Mathematics, 21.08.2019 18:20

Physics, 21.08.2019 18:20

History, 21.08.2019 18:20

Advanced Placement (AP), 21.08.2019 18:20