Business, 19.07.2020 14:01 6lost6soul6

During 2021, Farewell Inc. had 500,000 shares of common stock and 50,000 shares of 6% cumulative preferred stock outstanding. The preferred stock has a par value of $100 per share. Farewell did not declare or pay any dividends during 2021. Farewell's net income for the year ended December 31, 2021, was $2.5 million. The income tax rate is 25%. Farewell granted 10,000 stock options to its executives on January 1 of this year. Each option gives its holder the right to buy 20 shares of common stock at an exercise price of $29 per share. The options vest after one year. The market price of the common stock averaged $30 per share during 2021.

What is Farewell's diluted earnings per share for 2021, rounded to the nearest cent?

A) $3.14.

B) $4.90.

C) $4.34.

D) Cannot determine from the given information.

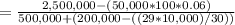

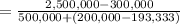

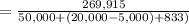

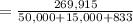

Blue Cab Company had 50,000 shares of common stock outstanding on January 1, 2021. On April 1, 2021, the company issued 20,000 shares of common stock. The company had outstanding fully vested incentive stock options for 5,000 shares exercisable at $10 that had not been exercised by its executives. The end-of-year market price of common stock was $13 while the average price for the year was $12. The company reported net income in the amount of $269,915 for 2021. What is the diluted earnings per share (rounded)?

A) $3.60.

B) $4.10.

C) $4.50.

D) $3.81.

Answers: 2

Another question on Business

Business, 22.06.2019 05:50

Which is one solution to levy the complexity of the global matrix strategy with added customer-focused dimensions?

Answers: 3

Business, 22.06.2019 11:00

When partners own different portions of the business, the terms should be stated clearly in what document? the articles of incorporation the executive summary the business summary the partnership agreement

Answers: 3

Business, 22.06.2019 19:30

Which of the following businesses is most likely to disrupt an existing industry? a. closer connex developed an earphone that receives emails and text messages and converts them to voice messages. the first models had poor reception, but they rapidly improved over time. b. mega technologies reconfigured the components used in its touchscreen tablets to create a new type of wearable device for use in restaurants and other service industries. c. particle inc. developed a teleportation technology that can transport physical materials instantaneously across great distances. d. altrea added advanced camera technology to its premium line of smartphones so that they would take the highest-quality photos of all phones on the market.

Answers: 1

Business, 23.06.2019 02:00

Imprudential, inc., has an unfunded pension liability of $572 million that must be paid in 25 years. to assess the value of the firm’s stock, financial analysts want to discount this liability back to the present. if the relevant discount rate is 6.5 percent, what is the present value of this liability? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89)

Answers: 3

You know the right answer?

During 2021, Farewell Inc. had 500,000 shares of common stock and 50,000 shares of 6% cumulative pre...

Questions

Computers and Technology, 21.02.2020 16:52

Computers and Technology, 21.02.2020 16:53

Mathematics, 21.02.2020 16:53

Mathematics, 21.02.2020 16:54