Business, 23.07.2020 21:01 kksavage36

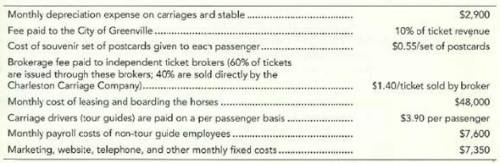

Colt Carriage Company offers guided horse-drawn carriage rides through historic Charleston comma South Carolina. The carriage business is highly regulated by the city. Colt Carriage Company has the following operating costs during April: LOADING...(Click the icon to view the information.) During April (a month during peak season), Colt Carriage Company had 13 comma 500 passengers. Sixty percent of passengers were adults ($23 fare) while 40% were children ($15 fare). Requirements 1. Prepare the company's contribution margin income statement for the month of April. Round all figures to the nearest dollar. 2. Assume that passenger volume increases by 10% in May. Which figures on the income statement would you expect to change, and by what percentage would they change? Which figures would remain the same as in April?

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

Cash flow is often a problem for small businesses. how can an entrepreneur increase cash flow? a) locate lower-priced suppliers. b) forego sending in estimated tax payments to the irs c) shorten the terms on a bank loan to pay it off more quickly d) sell more low-margin items.

Answers: 1

Business, 22.06.2019 20:30

Mordica company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $156,960, $382,800, and $84,640, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,180, machine hours 25,520, and number of inspections 1,840. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

Business, 22.06.2019 22:00

Miami incorporated estimates that its retained earnings break point (bpre) is $21 million, and its wacc is 13.40 percent if common equity comes from retained earnings. however, if the company issues new stock to raise new common equity, it estimates that its wacc will rise to 13.88 percent. the company is considering the following investment projects: project size irr a $4 million 14.00% b 5 million 15.10 c 4 million 16.20 d 6 million 14.20 e 1 million 13.42 f 6 million 13.75 what is the firm's optimal capital budget?

Answers: 3

Business, 22.06.2019 22:40

Effective capacity is the: a. capacity a firm expects to achieve given the current operating constraints.b. minimum usable capacity of a particular facility.c. sum of all the organization's inputs.d. average output that can be achieved under ideal conditions.e. maximum output of a system in a given period.

Answers: 1

You know the right answer?

Colt Carriage Company offers guided horse-drawn carriage rides through historic Charleston comma Sou...

Questions

Mathematics, 20.01.2020 03:31

Mathematics, 20.01.2020 03:31

Health, 20.01.2020 03:31

Mathematics, 20.01.2020 03:31

Biology, 20.01.2020 03:31

Biology, 20.01.2020 03:31

Mathematics, 20.01.2020 03:31

Mathematics, 20.01.2020 03:31