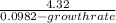

Use the Constant Dividend Growth Model to determine the expected annual growth rate of the dividend for ELO stock. The firm is expected to pay an annual divided of $4.32 per share in one year. ELO shares are currently trading for $92.51 on the NYSE, and the expected annual rate of return for ELO shares is 9.82%. Answer as a % to 2 decimal places (e. g., 12.34% as 12.34).

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 23.06.2019 00:30

What level of measurement (nominal, ordinal, interval, ratio) is appropriate for the movie rating system that you see in tv guide?

Answers: 2

Business, 23.06.2019 01:40

During a liquidation, a partner's capital account balance drops below zero. what should happen? select one: a. the deficit balance should be removed from the accounting records with only the remaining partners sharing in future gains and losses.b. the partner with a deficit should contribute enough assets to offset the deficit balance if he is solvent.c. the other partners should contribute enough assets to offset the amount of deficit if the partner with a deficit is insolvent.d. both b & c

Answers: 3

You know the right answer?

Use the Constant Dividend Growth Model to determine the expected annual growth rate of the dividend...

Questions

Physics, 26.05.2021 16:00

Mathematics, 26.05.2021 16:00

Physics, 26.05.2021 16:00

Mathematics, 26.05.2021 16:00

Mathematics, 26.05.2021 16:00

History, 26.05.2021 16:00

History, 26.05.2021 16:00

Mathematics, 26.05.2021 16:00

Chemistry, 26.05.2021 16:00

English, 26.05.2021 16:00

Advanced Placement (AP), 26.05.2021 16:00