Business, 01.08.2020 21:01 taliyahjhonson1

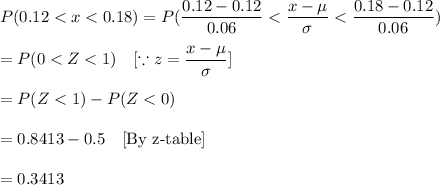

Suppose a stock has an expected return of 12% and a standard deviation of 6%. What is the likelihood that this stock returns between 12% and 18%

Answers: 1

Another question on Business

Business, 22.06.2019 21:40

Western electric has 32,000 shares of common stock outstanding at a price per share of $79 and a rate of return of 13.00 percent. the firm has 7,300 shares of 7.80 percent preferred stock outstanding at a price of $95.00 per share. the preferred stock has a par value of $100. the outstanding debt has a total face value of $404,000 and currently sells for 111 percent of face. the yield to maturity on the debt is 8.08 percent. what is the firm's weighted average cost of capital if the tax rate is 39 percent?

Answers: 2

Business, 22.06.2019 22:40

When immigration adds to the size of the domestic labor pool, which of the following is likely to occur? a. wages decrease. b. productivity increases. c. consumption decreases. d. minimum wage increases.

Answers: 1

Business, 22.06.2019 23:00

Which best describes what financial planning skills ultimately enable an individual to do? to prepare for the future to determine lifetime income to determine the cost of living to learn from the past

Answers: 1

Business, 23.06.2019 14:30

How does it the economy that banks offer incentives (like interest payments, deposit insurance, etc.) to get customers to deposit money with them?

Answers: 1

You know the right answer?

Suppose a stock has an expected return of 12% and a standard deviation of 6%. What is the likelihood...

Questions

Biology, 02.07.2019 10:20

Mathematics, 02.07.2019 10:20

Biology, 02.07.2019 10:20

Physics, 02.07.2019 10:20

Mathematics, 02.07.2019 10:20

English, 02.07.2019 10:20

Mathematics, 02.07.2019 10:20

Health, 02.07.2019 10:20

History, 02.07.2019 10:20