Business, 12.08.2020 20:01 ravenmcfarlandp07okx

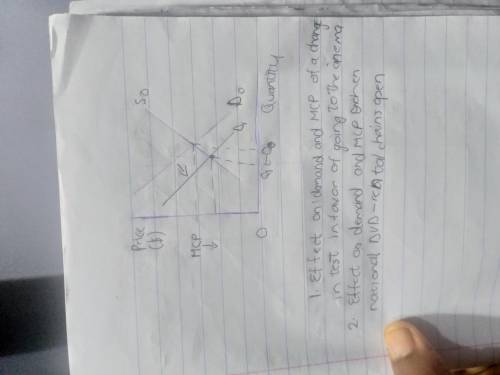

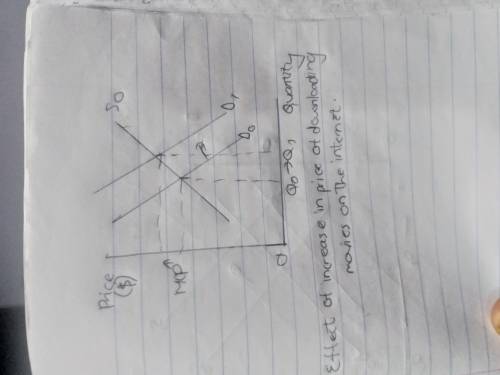

Consider the market for DVD movie rentals, which is perfectly competitive. The market supply curve slopes upward, the market demand curve sloped downward, and the equilibrium rental price equals $3.50. Consider each of the following events, and discuss the effects they will have on the market clearing price and the demand curve faced by the individual rental store. a. People’s tastes change in favor of going to see more movies at cinemas with their friends and family members. b. National DVD-rental chains open a number of new stores in this market. c. There is a significant increase in the price of downloading movies on the Internet.

Answers: 1

Another question on Business

Business, 21.06.2019 21:50

Franklin painting company is considering whether to purchase a new spray paint machine that costs $4,800. the machine is expected to save labor, increasing net income by $720 per year. the effective life of the machine is 15 years according to the manufacturer’s estimate. required determine the unadjusted rate of return based on the average cost of the investment.

Answers: 2

Business, 22.06.2019 05:50

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 10:30

The advertisement demonstrates a popular way companies try to sell a product. what should consumers consider when it comes to the price of this product? it includes shipping and handling costs. it takes into account maintenance costs. it explains why this price is a good deal. it makes the full cost appears lower than it is.

Answers: 1

You know the right answer?

Consider the market for DVD movie rentals, which is perfectly competitive. The market supply curve s...

Questions

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Computers and Technology, 16.11.2020 19:50

Social Studies, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

Mathematics, 16.11.2020 19:50

English, 16.11.2020 19:50

Social Studies, 16.11.2020 19:50