Business, 27.08.2020 21:01 Rogeartest4

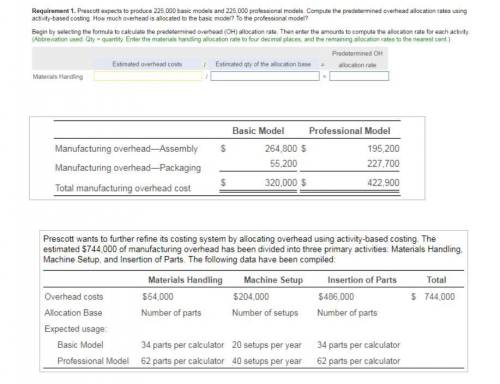

Prescott expects to produce 225,000 basic models and 225,000 professional models. Compute the predetermined overhead allocation rates using activity-based costing. How much overhead is allocated to the basic model? To the professional model?Estimated overhead cost / Estimated qty of the allocation base= Predetermined OH Basic Model Professional ModelManufacturing overhead assembly 264800 195200Manufacturing overhead packaging 55200 227700Total manufacturing overhead cost 320000 422900

Answers: 3

Another question on Business

Business, 22.06.2019 10:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. ( t or f)

Answers: 1

Business, 22.06.2019 11:10

Wilson company paid $5,000 for a 4-month insurance premium in advance on november 1, with coverage beginning on that date. the balance in the prepaid insurance account before adjustment at the end of the year is $5,000, and no adjustments had been made previously. the adjusting entry required on december 31 is: (a) debit cash. $5,000: credit prepaid insurance. $5,000. (b) debit prepaid insurance. $2,500: credit insurance expense. $2500. (c) debit prepaid insurance. $1250: credit insurance expense. $1250. (d) debit insurance expense. $1250: credit prepaid insurance. $1250. (e) debit insurance expense. $2500: credit prepaid insurance. $2500.

Answers: 1

Business, 22.06.2019 12:50

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 21:40

Western electric has 32,000 shares of common stock outstanding at a price per share of $79 and a rate of return of 13.00 percent. the firm has 7,300 shares of 7.80 percent preferred stock outstanding at a price of $95.00 per share. the preferred stock has a par value of $100. the outstanding debt has a total face value of $404,000 and currently sells for 111 percent of face. the yield to maturity on the debt is 8.08 percent. what is the firm's weighted average cost of capital if the tax rate is 39 percent?

Answers: 2

You know the right answer?

Prescott expects to produce 225,000 basic models and 225,000 professional models. Compute the predet...

Questions

Mathematics, 18.09.2021 02:10

Biology, 18.09.2021 02:10

Mathematics, 18.09.2021 02:10

Mathematics, 18.09.2021 02:10

Physics, 18.09.2021 02:10

English, 18.09.2021 02:10

Chemistry, 18.09.2021 02:10

English, 18.09.2021 02:10

Mathematics, 18.09.2021 02:10

Mathematics, 18.09.2021 02:10

Arts, 18.09.2021 02:10