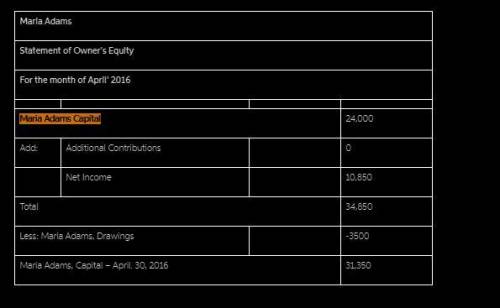

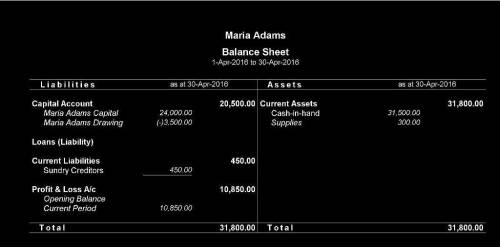

On April 1, 2016, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:A. Opened a business bank account with a deposit of $24,000 from personal funds. B. Paid rent on office and equipment for the month, $3,600.C. Paid automobile expenses (including rental charge) for month, $1,350, and miscellaneous expenses, $600.D. Purchased office supplies on account, $1,200.E. Earned sales commissions, receiving cash, $19,800.F. Paid creditor on account, $750.G. Paid office salaries, $2,500.H. Withdrew cash for personal use, $3,500.I. Determined that the cost of supplies on hand was $300; therefore, the cost of supplies used was $900.Required:1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings in the exhibit below. In each transaction row (rows indicated by a letter), you must indicate the math sign (+ or -) in columns affected by the transaction. You will not need to enter math signs in the balance rows (rows indicated by Bal.). Entries of 0 (zero) are not required and will be cleared if entered. Assets = Liabilities + Owner’s EquityMaria Maria Accounts Adams, Adams, Sales Salaries Rent Auto Supplies MiscellaneousCash + Supplies = Payable + Capital - Drawing + Commissions - Expense - Expense - Expense - Expense - Expense2. Prepare an income statement for April, a statement of owner’s equity for April, and a balance sheet as of April 30. Refer to the list of Accounts on the accounting equation grid and the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. If a net loss has been incurred, enter that amount as a negative number using a minus sign. You will not need to enter colons (:)

Answers: 2

Another question on Business

Business, 22.06.2019 10:50

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

Business, 22.06.2019 11:00

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 17:30

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

You know the right answer?

On April 1, 2016, Maria Adams established Custom Realty. Maria completed the following transactions...

Questions

English, 25.11.2019 23:31

Biology, 25.11.2019 23:31

History, 25.11.2019 23:31

Biology, 25.11.2019 23:31

English, 25.11.2019 23:31

Mathematics, 25.11.2019 23:31

History, 25.11.2019 23:31

History, 25.11.2019 23:31

Mathematics, 25.11.2019 23:31

Mathematics, 25.11.2019 23:31