Business, 02.09.2020 04:01 justhereforanswers13

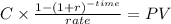

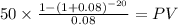

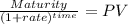

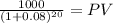

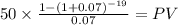

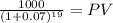

A newly issued bond pays its coupons once annually. Its coupon rate is 5%, its maturity is 20 years, and its yield to maturity is 8%. a. Find the holding-period return for a 1-year investment period if the bond is selling at a yield to maturity of 7% by the end of the year.

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Elizabeth believes her company has discriminated against her because her minority coworkers, who are less qualified, have been promoted ahead of her. which agency should elizabeth contact? - national alliance of business- affirmative action council- equal employment opportunity commission- federal trade commission- fair employment practices agency

Answers: 2

Business, 22.06.2019 04:30

Georgia's gross pay was 35,600 this year she is to pay a federal income tax of 16% how much should georgia pay in federal income ax this year

Answers: 1

Business, 22.06.2019 08:20

How much does a neurosurgeon can make most in canada? give me answer in candian dollar

Answers: 1

Business, 22.06.2019 16:10

Answer the following questions using the banker’s algorithm: a. illustrate that the system is in a safe state by demonstrating an order in which the processes may complete. b. if a request from process p1 arrives for (1, 1, 0, 0), can the request be granted immediately? c. if a request from process p

Answers: 1

You know the right answer?

A newly issued bond pays its coupons once annually. Its coupon rate is 5%, its maturity is 20 years,...

Questions

History, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10

Social Studies, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10

History, 06.01.2021 22:10

Biology, 06.01.2021 22:10

Mathematics, 06.01.2021 22:10