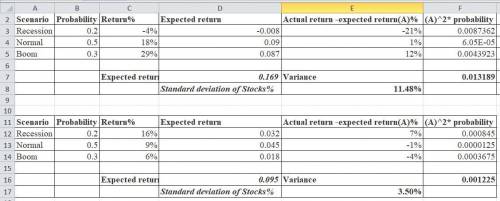

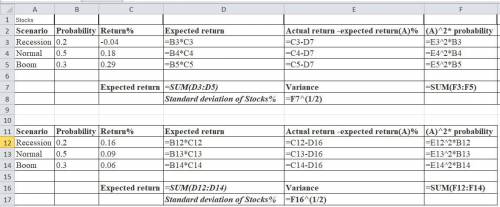

Consider the following scenario analysis:Rate of Return Scenario Probability Stocks BondsRecession 0.20 -4 % 16 %Normal economy 0.50 18 % 9 %Boom 0.30 29 % 6 %a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer?

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

When using various forms of promotion to carry the promotion message, it is important that the recipients of the message interpret it in the same way. creating a unified promotional message, where potential customers perceive the same message, whether it is in a tv commercial, or on a billboard, or in a blog, is called

Answers: 2

Business, 22.06.2019 20:50

How has apple been able to sustain its competitive advantage in the smartphone industry? a. by reducing its network effects b. by targeting its new products and services toward laggards c. by driving the price for the end user to zero d. by regularly introducing incremental improvements in its products

Answers: 1

Business, 22.06.2019 21:30

Providing a great shopping experience to customers is one of the important objectives of purple fashions inc., a clothing store. to achieve this objective, the company has a team of committed customer service professionals whose job is to ensure that customers get exactly what they want. this scenario illustrates that purple fashions is trying to achieve

Answers: 1

You know the right answer?

Consider the following scenario analysis:Rate of Return Scenario Probability Stocks BondsRecession 0...

Questions

Mathematics, 05.03.2020 10:00

Mathematics, 05.03.2020 10:01

History, 05.03.2020 10:02

Mathematics, 05.03.2020 10:02