Business, 20.09.2020 19:01 MariaGuerra

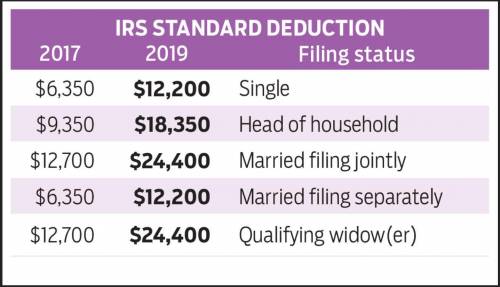

Jason and Mary are married taxpayers in 2019. They are both under age 65 and in good health. For 2019 they have a total of $41,000 in wages and $700 in interest income. Jason and Mary's deductions for adjusted gross income amount to $5,000 and their itemized deductions equal $18,700. They have two children, ages 32 and 28, that are married and provide support for themselves.

Required:

a. What is the amount of Jason and Mary's adjusted gross income?

b. What is the amount of their itemized deductions or standard deduction?

c. What is their 2016 taxable income?

Answers: 1

Another question on Business

Business, 21.06.2019 17:20

Luis and rosa, citizens of costa rica, moved to the united states in year 1 where they both lived and worked. in year 3, they provided the total support for their four young children (all under the age of 10). two children lived with luis and rosa in the u.s., one child lived with his aunt in mexico, and one child lived with her grandmother in costa rica. none of the children earned any income. all of the children were citizens of costa rica. the child in mexico was a resident of mexico, and the child in costa rica was a resident of costa rica. how many total exemptions (personal exemptions plus exemptions for dependents) may luis and rosa claim on their year 3 joint income tax return? a. 6 b. 5 c. 4 d. 2

Answers: 3

Business, 22.06.2019 18:00

If you would like to ask a question you will have to spend some points

Answers: 1

Business, 22.06.2019 19:20

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

Business, 22.06.2019 20:40

If the ceo of a large, diversified, firm were filling out a fitness report on a division manager (i.e., "grading" the manager), which of the following situations would be likely to cause the manager to receive a better grade? in all cases, assume that other things are held constant.a. the division's basic earning power ratio is above the average of other firms in its industry.b. the division's total assets turnover ratio is below the average for other firms in its industry.c. the division's debt ratio is above the average for other firms in the industry.d. the division's inventory turnover is 6, whereas the average for its competitors is 8.e. the division's dso (days' sales outstanding) is 40, whereas the average for its competitors is 30.

Answers: 1

You know the right answer?

Jason and Mary are married taxpayers in 2019. They are both under age 65 and in good health. For 201...

Questions

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

English, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Social Studies, 11.09.2020 02:01

Mathematics, 11.09.2020 02:01

Mathematics, 11.09.2020 03:01

Chemistry, 11.09.2020 03:01

History, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

English, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

Business, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01

Mathematics, 11.09.2020 03:01