Business, 02.10.2020 16:01 adamkladke

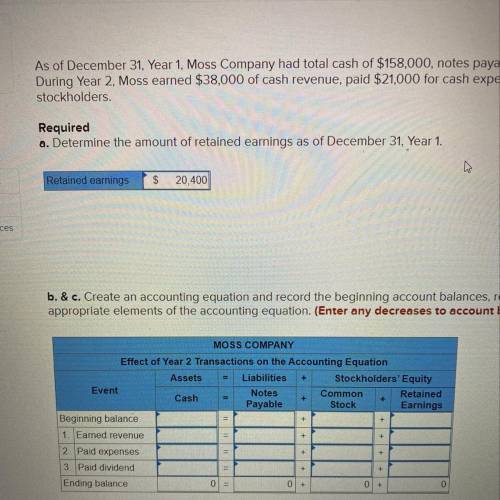

As of December 31, Year 1. Moss Company had total cash of $158,000, notes payable of $85,800, and common stock of $52,600.

During Year 2, Moss earned $38,000 of cash revenue, paid $21,000 for cash expenses, and paid a $3,200 cash dividend to the

stockholders.

Required

a. Determine the amount of retained earnings as of December 31, Year 1.

Retained earnings

$ 20,400 <— i know this

b.&c. Create an accounting equation and record the beginning account balances, revenue, expense, and dividend events under the

appropriate elements of the accounting equation.

(Enter any decreases to account balances with a minus sign.)

MOSS COMPANY

Effect of Year 2 Transactions on the Accounting Equation

Assets Liabilities Stockholders' Equity

Event

Notes

Cash

Common Retained

Payable

Stock

Earnings

Beginning balance

1. Earned revenue

2. Paid expenses

3. Paid dividend

Ending balance

How do i input it , in the chart

Answers: 3

Another question on Business

Business, 22.06.2019 04:00

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

Business, 22.06.2019 13:30

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Business, 22.06.2019 23:30

At the save the fish nonprofit organization, jenna is responsible for authorizing outgoing payments, rob takes care of recording the payments in the organization's computerized accounting system, and shannon reconciles the organization's bank statements each month. this internal accounting control is best known as a(n) a. distribution process. b. segregation of duties c. specialized budget d. annotated financial process

Answers: 2

You know the right answer?

As of December 31, Year 1. Moss Company had total cash of $158,000, notes payable of $85,800, and co...

Questions

Mathematics, 30.09.2020 02:01

Mathematics, 30.09.2020 02:01

Computers and Technology, 30.09.2020 02:01

Mathematics, 30.09.2020 02:01

Mathematics, 30.09.2020 02:01

Health, 30.09.2020 02:01

History, 30.09.2020 02:01

Chemistry, 30.09.2020 02:01

Chemistry, 30.09.2020 02:01

History, 30.09.2020 02:01

Mathematics, 30.09.2020 02:01