Business, 02.10.2020 16:01 leilakainani26

All-Star Automotive Company experienced the following accounting events during Year 1

1. Performed services for $15,900 cash.

2. Purchased land for $8.900 cash.

3. Hired an accountant to keep the books.

4. Received $49,000 cash from the issue of common stock

5. Borrowed $11,800 cash from State Bank.

6. Paid $5.900 cash for salary expense.

7. Sold land for $11.800 cash.

8. Paid $4.900 cash on the loan from State Bank.

9. Paid $6,100 cash for utilities expense.

10. Paid a cash dividend of $2,900 to the stockholders.

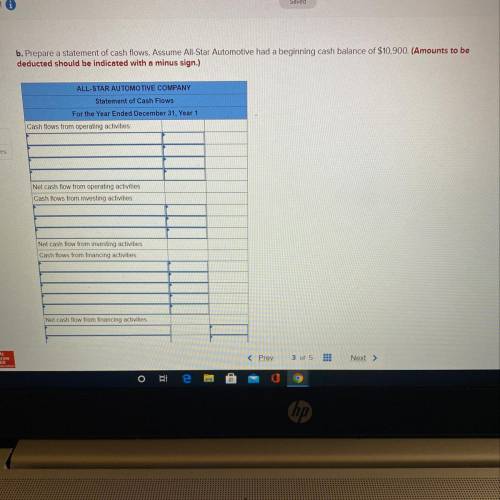

Required

a. Indicate how each of the events would be classified on the statement of cash flows as operating activities (OA), investing activities

(1A), financing activities (FA), or not applicable (NA).

Event / Classification

1

2

4

5

5

7

8

10

2 part question. Please help me with both

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 21:10

Kinc. has provided the following data for the month of may: inventories: beginning ending work in process $ 17,000 $ 12,000 finished goods $ 46,000 $ 50,000 additional information: direct materials $ 57,000 direct labor cost $ 87,000 manufacturing overhead cost incurred $ 63,000 manufacturing overhead cost applied to work in process $ 61,000 any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. the adjusted cost of goods sold that appears on the income statement for may is:

Answers: 3

Business, 23.06.2019 00:00

What is a uniform law adopted by all states that facilitates business transactions?

Answers: 1

Business, 23.06.2019 03:00

On december 31, 2016, the decarreau, andrew, and bui partnership had the following fiscal year-end balance sheet: cash $10,000accounts receivable $20,000inventory $25,000plant assets - net $30,000loan to decarreau $18,000total assets $103,000accounts payable $14,000loan from bui $15,000decarreaua, capital (20%) $32,000andrew, capital (10%) $23,000bui, capital (70%) $19,000total liab./equity $103,000the percentages shown are the residual profit and loss sharing ratios. the partners dissolved the partnership on january 1, 2017, and began the liquidation process. during july the following events occurred: * receivables of $18,000 were collected.* all inventory was sold for $15,000.*all available cash was distributed on january 31, except for$8,000 that was set aside for contingent expenses.the book value of the partnership equity (i.e., total equity of the partners) on december 31, 2016 isa. $58,000b. $71,000c. $66,000d. $81,000

Answers: 1

You know the right answer?

All-Star Automotive Company experienced the following accounting events during Year 1

1. Performed...

Questions

Computers and Technology, 21.08.2021 03:10

Mathematics, 21.08.2021 03:10

Computers and Technology, 21.08.2021 03:10