Business, 04.10.2020 14:01 makayladurham19

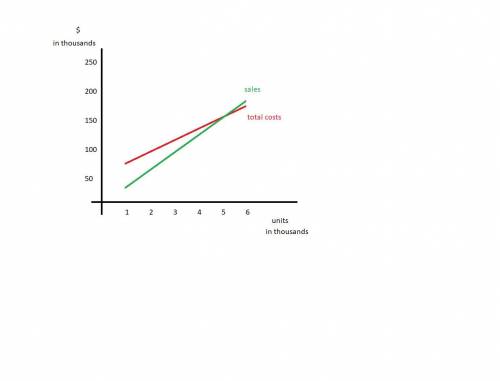

East Publishing Company is doing an analysis of a proposed new finance text. Using the following data, answer Parts a through e. Fixed Costs (per edition): Development (reviews, class testing, and so on) $18,000 Copyediting 5,000 Selling and promotion 7,000 Typesetting 40,000 Total $70,000 Variable Costs (per copy): Printing and binding $4.20 Administrative costs 1.60 Salespeople’s commission (2% of selling price) .60 Author’s royalties (12% of selling price) 3.60 Bookstore discounts (20% of selling price) 6.00 Total $ 16.00 Projected Selling Price $ 30.00 The company’s marginal tax rate is 40 percent. a. Determine the company’s breakeven volume for this book. •i. In units ii. In dollar sales b. Develop a breakeven chart for the text. c. Determine the number of copies East must sell in order to earn an (operating) profit of $21,000 on this text. d. Determine total (operating) profits at the following sales levels: i. 3,000 units •ii. 5,000 units iii. 10,000 units e. Suppose East feels that $30.00 is too high a price to charge for the new finance text. It has examined the competitive market and determined that $24.00 would be a better selling price. What would the breakeven volume be at this new selling price?

Answers: 1

Another question on Business

Business, 21.06.2019 18:30

Which of the following is located at the point where the supply and demand curves intersect? a. the equilibrium price. b. the minimum supply. c. the level of efficient production. d. the maximum demand. 2b2t

Answers: 1

Business, 22.06.2019 18:00

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

Business, 22.06.2019 20:10

Given the following information, calculate the savings ratio: liabilities = $25,000 liquid assets = $5,000 monthly credit payments = $800 monthly savings = $760 net worth = $75,000 current liabilities = $2,000 take-home pay = $2,300 gross income = $3,500 monthly expenses = $2,050 multiple choice 2.40% 3.06% 34.78% 33.79% 21.71%

Answers: 2

You know the right answer?

East Publishing Company is doing an analysis of a proposed new finance text. Using the following dat...

Questions

Business, 16.10.2021 19:00

English, 16.10.2021 19:00

History, 16.10.2021 19:00

History, 16.10.2021 19:00

SAT, 16.10.2021 19:00

Biology, 16.10.2021 19:00