Business, 08.10.2020 17:01 cakecake15

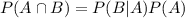

A company studied the number of lost-time accidents occurring at its Brownsville, Texas, plant. Historical records show that of the employees suffered lost-time accidents last year. Management believes that a special safety program will reduce such accidents to during the current year. In addition, it estimates that of employees who had lost-time accidents last year will experience a lost-time accident during the current year.

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

In its 2016 annual report, caterpillar inc. reported the following (in millions): 2016 2015 sales $38,537 $47,011 cost of goods sold 28,309 33,546 as a percentage of sales, did caterpillar's gross profit increase or decrease during 2016? select one: a. gross profit increased from 26.8% to 28.6% b. gross profit decreased from 28.6% to 26.5% c. gross profit increased from 71.4% to 73.2% d. gross profit decreased from 73.2% to 71.4% e. there is not enough information to answer the question.

Answers: 2

Business, 22.06.2019 08:30

Acompany recorded a check in its accounting records as $87. however, the check was actually written for $78 and it cleared the bank as $78. what adjustment is needed to the personal statement? a. decrease by $9 b. increase by $9 c. decrease by $18 d. increase by $9

Answers: 2

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 18:00

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

You know the right answer?

A company studied the number of lost-time accidents occurring at its Brownsville, Texas, plant. Hist...

Questions

English, 30.07.2021 05:10

English, 30.07.2021 05:10

Medicine, 30.07.2021 05:10

Mathematics, 30.07.2021 05:10

Mathematics, 30.07.2021 05:10

Physics, 30.07.2021 05:10

Mathematics, 30.07.2021 05:10

English, 30.07.2021 05:10

= 15%

= 15%