Business, 12.10.2020 20:01 tommyaberman

Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.)

Income Statement 2020

Sales $ 5,760,000

Cost of goods sold 3,045,000

Depreciation 302,500

Selling and administrative expenses 1,620,000

EBIT $ 792,500

Interest expense 174,000

Taxable income $ 618,500

Taxes 281,300

Net income $ 337,200

Balance Sheet, Year-End 2020 2019

Assets

Cash $ 41,100 $ 95,000

Accounts receivable 590,000 1,648,200

Inventory 438,100 1,146,500

Total current assets $ 1,069,200 $ 2,889,700

Fixed assets 2,821,000 6,771,000

Total assets $ 3,890,200 $ 9,660,700

Liabilities and Stockholders' Equity Accounts payable $ 312,400 $ 1,176,000

Short-term debt 505,000 1,445,500

Total current liabilities $ 817,400 $ 2,621,500

Long-term bonds 1,733,800 5,777,400

Total liabilities $ 2,551,200 $ 8,398,900

Common stock $ 313,900 $ 313,900

Retained earnings 1,025,100 947,900

Total stockholders' equity $ 1,339,000 $ 1,261,800

Total liabilities and stockholders' equity $ 3,890,200 $ 9,660,700

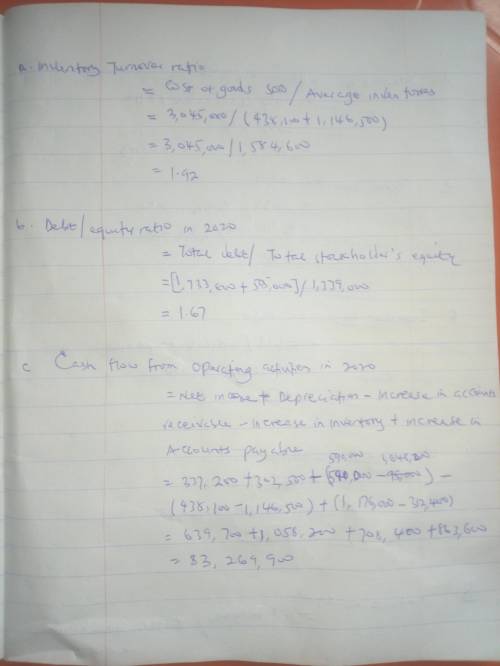

a. Inventory turnover ratio

b. Debt/equity ratio in 2020

c. Cash flow from operating activities in 2020

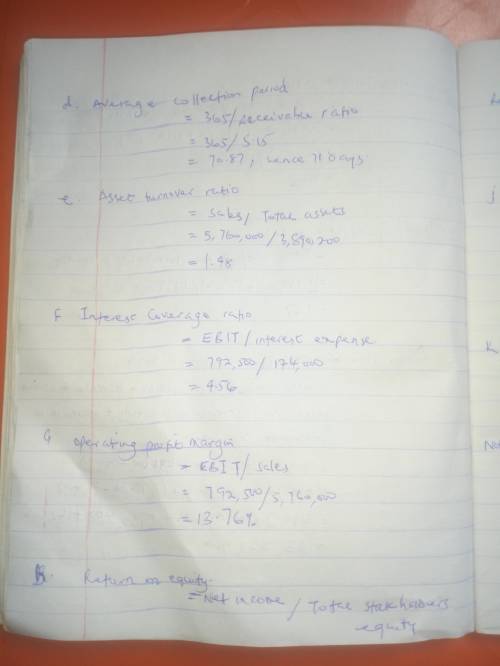

d. Average collection period

e. Asset turnover ratio

f. Interest coverage ratio

g. Operating profit margin

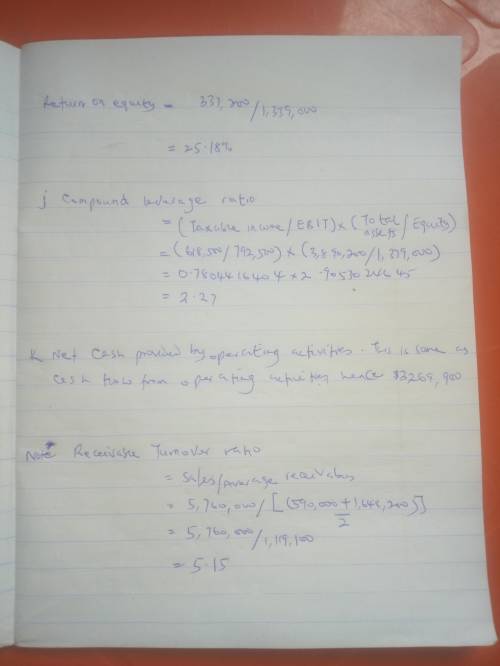

h. Retun on equity

J. Compound leverage ratio

k. Net cash provided by operating activities

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

The sticky-price theory asserts that the output prices of some goods and services adjust slowly to changes in the price level. suppose firms announce the prices for their products in advance, based on an expected price level of 100 for the coming year. many of the firms sell their goods through catalogs and face high costs of reprinting if they change prices. the actual price level turns out to be 110. faced with high menu costs, the firms that rely on catalog sales choose not to adjust their prices. sales from catalogs will

Answers: 3

Business, 22.06.2019 02:30

The dollar value generated over decades of customer loyalty to your company is known as brand equity. viability. sustainability. luck.

Answers: 1

Business, 22.06.2019 17:30

The purchasing agent for a company that assembles and sells air-conditioning equipment in a latin american country noted that the cost of compressors has increased significantly each time they have been reordered. the company uses an eoq model to determine order size. what are the implications of this price escalation with respect to order size? what factors other than price must be taken into consideration?

Answers: 1

Business, 22.06.2019 23:10

Powell company began the 2018 accounting period with $40,000 cash, $86,000 inventory, $60,000 common stock, and $66,000 retained earnings. during 2018, powell experienced the following events: sold merchandise costing $58,000 for $99,500 on account to prentise furniture store. delivered the goods to prentise under terms fob destination. freight costs were $900 cash. received returned goods from prentise. the goods cost powell $4,000 and were sold to prentise for $5,900. granted prentise a $3,000 allowance for damaged goods that prentise agreed to keep. collected partial payment of $81,000 cash from accounts receivable. required record the events in a statements model shown below. prepare an income statement, a balance sheet, and a statement of cash flows. why would prentise agree to keep the damaged goods?

Answers: 2

You know the right answer?

Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 36...

Questions

Mathematics, 02.10.2020 18:01

Mathematics, 02.10.2020 18:01

Social Studies, 02.10.2020 18:01

Mathematics, 02.10.2020 18:01

Mathematics, 02.10.2020 18:01

English, 02.10.2020 18:01

Chemistry, 02.10.2020 18:01

History, 02.10.2020 18:01

Mathematics, 02.10.2020 18:01

History, 02.10.2020 18:01

Mathematics, 02.10.2020 18:01

Mathematics, 02.10.2020 18:01

Chemistry, 02.10.2020 18:01