Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019.

Duke Company Lord Company

2020 2019 2020 2019

Net sales $1,866,000 $559,000

Cost of goods sold 1,059,888 297,388

Operating expenses 264,972 78,819

Interest expense 7,464 4,472

Income tax expense 54,114 6,149

Current assets 323,000 $311,200 82,000 $78,300

Plant assets (net) 521,400 501,200 138,300 125,100

Current liabilities 66,000 75,600 36,200 31,000

Long-term liabilities 108,200 90,200 29,000 24,600

Common stock, $10 par 496,000 496,000 122,000 122,000

Retained earnings 174,200 150,600 33,100 25,800

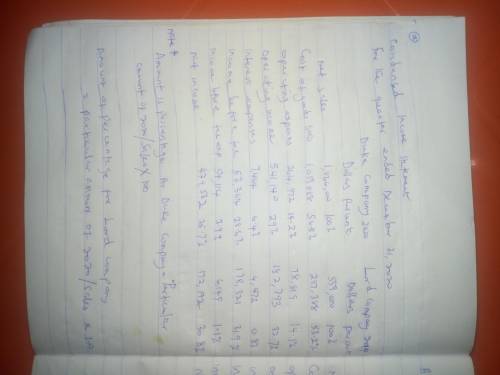

A) Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company.

Condensed Income Statement

For the Year Ended December 31, 2017

Duke Company Lord Company

Dollars % Dollars %

Net Sales 1,849,000 100% $546,000 100%

Cost of Goods Sold 1,063,200 57.5% 289,000 52.9%

Gross Profit $785,800 42.52% 57,000 47%

Operating Expenses 240,000 12.9% 82,000 15%

Income from Operations 545,800 29.5% 175,000 32%

Other Expenses and Loses

Interest Expense 6,800 0.4% 3,600 0.7%

Income Before Income

Tax 539,000 29.2% 171,400 31.4%

Income Tax Expense 62,000 3.4% 28,000 5.1%

Net Income/Loss $477,000 25.8% $143,400 26.3%

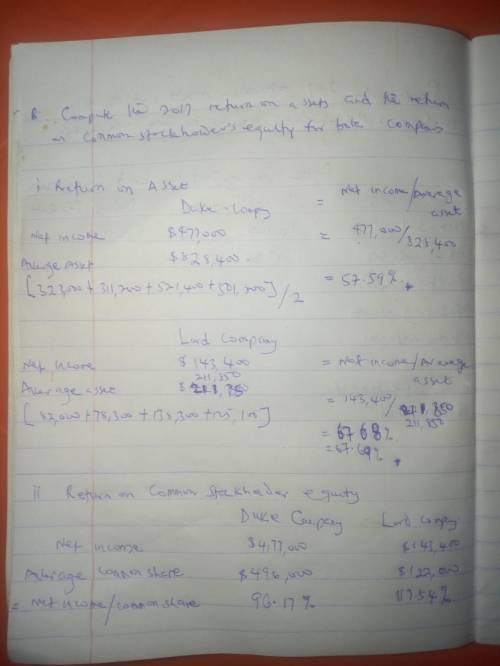

B) Compute the 2017 return on assets and the return on common stockholders’ equity for both companies.

Answers: 1

Another question on Business

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

Business, 22.06.2019 22:30

Which of the following situations is most likely to change a buyer's market into a seller's market? a. a natural disaster that drives away a lot of the population. b. the price of building materials suddenly going up. c. the government buys up a lot of houses to build a new freeway. d. a factory laying off a lot of workers in the area.

Answers: 1

Business, 23.06.2019 10:00

If a business is in need of working capital, one option is to use a(n) that will buy the company's account receivables and then handle their collection for a fee.

Answers: 2

You know the right answer?

Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance...

Questions

Mathematics, 12.01.2021 20:00

English, 12.01.2021 20:00

Chemistry, 12.01.2021 20:00

Mathematics, 12.01.2021 20:00

Mathematics, 12.01.2021 20:00

Mathematics, 12.01.2021 20:00

Mathematics, 12.01.2021 20:00

Mathematics, 12.01.2021 20:00

English, 12.01.2021 20:00