Business, 13.10.2020 03:01 davidcortez27

Techuxia Corporation worked on four jobs during October: Job A256, Job A257, Job A258, and Job A260. At the end of October, the job cost sheets for these jobs contained the following data:

Job A256 Job A257 Job A258 Job A260

Beginning balance $920 $640 $0 $0

Charged to the jobs during October:

Direct materials $2,750 $4,020 $1,550 $3,750

Direct labor $1,150 $930 $650 $460

Manufacturing overhead

applied $4,420 $1,760 $2,345 $400

Units completed 210 0 101 0

Units in process at the

end of October 0 310 0 253

Units sold during October 155 0 52 0

Jobs A256 and A258 were completed during October. The other two jobs had not yet been completed at the end of October. There was no finished goods inventory on October 1. In October, overhead was overapplied by $1,380. The company adjusts its cost of goods sold every month for the amount of the underapplied or overapplied overhead.

Required:

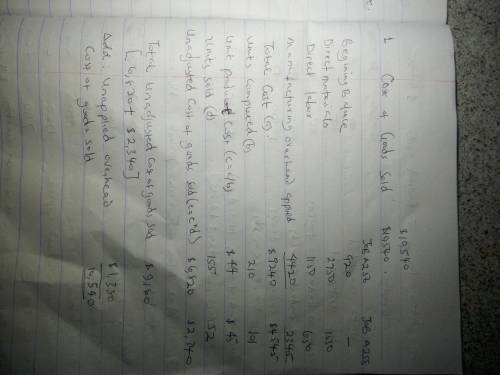

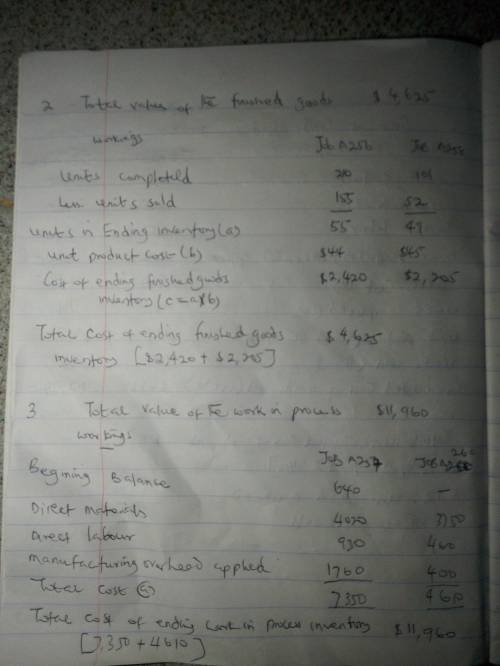

1. Using the direct method, what is the cost of goods sold for October?

2. What is the total value of the finished goods inventory at the end of October?

3. What is the total value of the work in process inventory at the end of October?

Answers: 1

Another question on Business

Business, 21.06.2019 17:20

Luis and rosa, citizens of costa rica, moved to the united states in year 1 where they both lived and worked. in year 3, they provided the total support for their four young children (all under the age of 10). two children lived with luis and rosa in the u.s., one child lived with his aunt in mexico, and one child lived with her grandmother in costa rica. none of the children earned any income. all of the children were citizens of costa rica. the child in mexico was a resident of mexico, and the child in costa rica was a resident of costa rica. how many total exemptions (personal exemptions plus exemptions for dependents) may luis and rosa claim on their year 3 joint income tax return? a. 6 b. 5 c. 4 d. 2

Answers: 3

Business, 21.06.2019 20:30

At a young age, ebony's coaches were confident she had the potential to be a world-class swimmer with a future coaching career. after four years on an athletic scholarship and olympic experience under her belt, she chose a different path. with her savings and personal connections, she rented a corner building in a bustling san francisco neighborhood and pursued her dream: a surf shop business. ebony's dream was rooted in which basic right of free-market capitalism?

Answers: 3

Business, 22.06.2019 03:30

Assume that all of thurmond company’s sales are credit sales. it has been the practice of thurmond company to provide for uncollectible accounts expense at the rate of one-half of one percent of net credit sales. for the year 20x1 the company had net credit sales of $2,021,000 and the allowance for doubtful accounts account had a credit balance, before adjustments, of $630 as of december 31, 20x1. during 20x2, the following selected transactions occurred: jan. 20 the account of h. scott, a deceased customer who owed $325, was determined to be uncollectible and was therefore written off. mar. 16 informed that a. nettles, a customer, had been declared bankrupt. his account for $898 was written off. apr. 23 the $906 account of j. kenney & sons was written off as uncollectible. aug. 3 wrote off as uncollectible the $750 account of clarke company. oct. 20 wrote off as uncollectible the $1,130 account of g. michael associates. oct. 27 received a check for $325 from the estate of h. scott. this amount had been written off on january 20 of the current year. dec. 20 cater company paid $7,000 of the $7,500 it owed thurmond company. since cater company was going out of business, the $500 balance it still owed was deemed uncollectible and written off. required: prepare journal entries for the december 31, 20x1, and the seven 20x2 transactions on the work sheets provided at the back of this unit. then answer questions 8 and 9 on the answer sheet. t-accounts are also provided for your use in answering these questions. 8. which one of the following entries should have been made on december 31, 20x1?

Answers: 1

Business, 22.06.2019 16:50

Arestaurant that creates a new type of sandwich is using (blank) as a method of competition.

Answers: 1

You know the right answer?

Techuxia Corporation worked on four jobs during October: Job A256, Job A257, Job A258, and Job A260....

Questions

Mathematics, 19.10.2020 01:01

Biology, 19.10.2020 01:01

English, 19.10.2020 01:01

Mathematics, 19.10.2020 01:01

English, 19.10.2020 01:01

Spanish, 19.10.2020 01:01

Mathematics, 19.10.2020 01:01

English, 19.10.2020 01:01