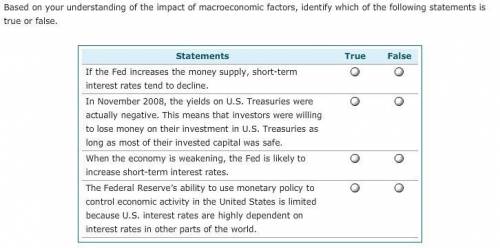

Based on your understanding of the impact of macroeconomic factors, identify which of the following statements is true or false.

a. The larger the federal deficit, other things held constant, the higher are interest rates.

b. If the Fed injects a huge amount of money in the markets, inflation is expected to decline, and long-term interest rates are expected to rise.

c. In November 2008, the yields on U. S. Treasuries were actually negative. This means that investors were willing to lose money on their investment in U. S.

d. Treasuries as long as most of their invested capital was safe.

e. The Federal Reserve’s ability to use monetary policy to control economic activity in the United States is limited because U. S. interest rates are highly dependent on interest rates in other parts of the world.

Answers: 1

Another question on Business

Business, 21.06.2019 23:10

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. required: a. journalize the adjusting entry to record the accrued fees on december 31. refer to the chart of accounts for exact wording of account titles. b. if the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary?

Answers: 2

Business, 22.06.2019 11:00

If the guide wprds on the page are "crochet " and "crossbones", which words would not be on the page. criticize, crocodile,croquet,crouch,crocus.

Answers: 1

Business, 22.06.2019 11:10

The green fiddle has declared a $5 per share dividend. suppose capital gains are not taxed, but dividends are taxed at 15 percent. new irs regulations require that taxes be withheld at the time the dividend is paid. green fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. what will the ex-dividend price be?

Answers: 2

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

You know the right answer?

Based on your understanding of the impact of macroeconomic factors, identify which of the following...

Questions

Mathematics, 06.12.2020 21:20

Biology, 06.12.2020 21:20

Mathematics, 06.12.2020 21:20

Mathematics, 06.12.2020 21:20

Mathematics, 06.12.2020 21:20

Biology, 06.12.2020 21:20

Mathematics, 06.12.2020 21:20

Mathematics, 06.12.2020 21:20

Biology, 06.12.2020 21:20

Mathematics, 06.12.2020 21:20

Social Studies, 06.12.2020 21:20

Spanish, 06.12.2020 21:20

Computers and Technology, 06.12.2020 21:20