Business, 16.10.2020 07:01 reneebrown017

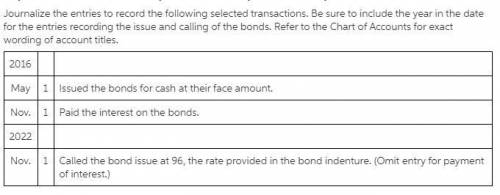

Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issued $15,000,000 of 20-year, 9% callable bonds on May 1, 20Y1, at their face amount, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year.

Answers: 2

Another question on Business

Business, 21.06.2019 14:50

Answer the following questions with true or false and provide a brief explanation (2- 3 sentences) a) economies of scale in production give rise to multi-product firms. b) ace hardware corporation is an example of economies of scale in production.

Answers: 3

Business, 21.06.2019 23:30

Acompany is developing a new highperformance wax for cross country ski racing. in order to justify the price marketingwants, the wax needs to be very fast. specifically, the mean time to finish their standard test course should be less thanseconds for a former olympic champion. to test it, the champion will ski the course 8 times. the champion's times(selected at random) are 59.9 61.9 48.8 52.2 46.6 45.3 50.6 and 41.1 seconds to complete the test course. complete parts a and b below.a) should they market the wax? assume the assumptions and conditions for appropriate hypothesis testing are metfor the sample.assume=0.05. what are the null and alternative hypotheses? choose the correct answer below.b) suppose they decide not to market the wax after the test, but it turns out that the wax really does lower the champion'saverage time to less thanseconds. what kind of error have they made? explain the impact to the company of such anerror.

Answers: 2

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

You know the right answer?

Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issu...

Questions

Chemistry, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

English, 20.10.2020 22:01

Law, 20.10.2020 22:01

Arts, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

Physics, 20.10.2020 22:01

Mathematics, 20.10.2020 22:01

English, 20.10.2020 22:01