Business, 16.10.2020 18:01 jaylynomalley

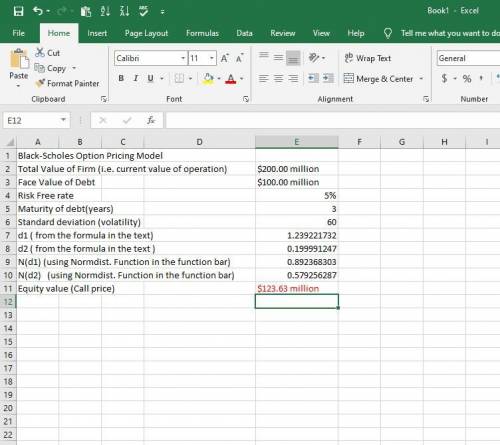

Higgs Bassoon Corporation is a custom manufacturer of bassoons and other wind instruments. Its current value of operations, which is also its value of debt plus equity, is estimated to be $200 million. Higgs has $110 million face value, zero coupon debt that is due in 3 years. The risk-free rate is 5%, and the standard deviation of returns for similar companies is 60%. The owners of Higgs Bassoon view their equity investment as an option and would like to know the value of their investment.

Required:

Using the Black-Scholes Option Pricing Model, how much is the equity worth?

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Afinancial institution, the thriftem bank, is in the process of formulating its loan policy for the next quarter. a total of $12 million is allocated for that purpose. being a full-service facility, the bank is obligated to grant loans to different clientele. the following table provides the types of loans, the interest rate charged by the bank, and the possibility of bad debt as estimated from past experience.type of loaninterest rateprobability of bad debtpersonal.140.10car.130.07home.120.03farm.125.05commercial.100.02 bad debts are assumed unrecoverable and hence produce no interest revenue either. competition with other financial institutions in the area requires that the bank allocate at least 40% of the total funds to farm and commercial loans. to assist the housing industry in the region, home loans must equal at least 50% of the personal, car, and home loans. the bank also has a stated policy specifying that the overall ratio for bad debts on all loans may not exceed .04. formulate this problem as a linear program. define your variables clearly and write all the constraints explaining the significance of each.

Answers: 1

Business, 22.06.2019 20:20

Carmen’s beauty salon has estimated monthly financing requirements for the next six months as follows: january $ 9,000 april $ 9,000 february 3,000 may 10,000 march 4,000 june 5,000 short-term financing will be utilized for the next six months. projected annual interest rates are: january 9 % april 16 % february 10 may 12 march 13 june 12 what long-term interest rate would represent a break-even point between using short-term financing and long-term financing?

Answers: 3

Business, 22.06.2019 23:30

Which statement best describes the two reactions? abcl, + h2 → 2hci2h + h = he + inreaction a involves a greater change, and reaction b involves a change in element identity.reaction b involves a greater change and a change in element identityreaction a involves a greater change and a change in element identity.reaction b involves a greater change, and reaction a involves a change in element identity.

Answers: 1

Business, 23.06.2019 17:00

Allen's office department manufactures computer desks in its​ moosejaw, saskatchewan, plant. the company uses activity based costing to allocate all manufacturing conversion costs​ (direct labour and manufacturing​ overhead). its activities and related data​ follow: ​(click the icon to view the activity areas and related​ data.) requirements 1. compute the​ per-unit manufacturing product cost of standard desks and unpainted desks. 2. premanufacturing​ activities, such as product​ design, were assigned to the standard desks at $ 5 each and to the unpainted desks at $ 2 each. similar analyses were conducted of postmanufacturing​ activities, such as​ distribution, marketing, and customer service. the postmanufacturing costs were $ 31 per standard and $ 26 per unpainted desk. compute the full product costs per desk. 3. which product costs are reported in the external financial​ statements? which costs are used for management decision​ making? explain the difference. 4. what price should allen's managers set for standard desks to earn a $ 52 profit per​ desk?

Answers: 2

You know the right answer?

Higgs Bassoon Corporation is a custom manufacturer of bassoons and other wind instruments. Its curre...

Questions

Social Studies, 03.05.2021 02:40

English, 03.05.2021 02:40

Chemistry, 03.05.2021 02:40

Mathematics, 03.05.2021 02:40

Mathematics, 03.05.2021 02:40

Mathematics, 03.05.2021 02:40

English, 03.05.2021 02:40

Biology, 03.05.2021 02:40

History, 03.05.2021 02:40

Mathematics, 03.05.2021 02:40

SAT, 03.05.2021 02:40

Chemistry, 03.05.2021 02:40