Business, 16.10.2020 14:01 jdvazquez18p7a7vs

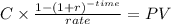

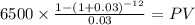

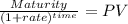

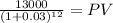

The lease agreement specified quarterly payments of $6,500 beginning September 30, 2021, the beginning of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2024 (three-year lease term). The florist had the option to purchase the truck on September 29, 2023, for $13,000 when it was expected to have a residual value of $19,000. The estimated useful life of the truck is four years. Mid-South Auto Leasing’s quarterly interest rate for determining payments was 3% (approximately 12% annually). Mid-South paid $51,000 for the truck. Both companies use straight-line depreciation or amortization. Anything Grows’ incremental interest rate is 12%.

Required:

a. Calculate the amount of selling profit that Mid-South would recognize in this sales-type lease. (Be careful to note that, although payments occur on the last calendar day of each quarter, since the first payment was at the beginning of the lease, payments represent an annuity due.)

b. Prepare the appropriate entries for Anything Grows and Mid-South on September 30, 2021.

c. Prepare an amortization schedule(s) describing the pattern of interest expense for Anything Grows and interest revenue for Mid- South Auto Leasing over the lease term.

d. Prepare the appropriate entries for Anything Grows and Mid-South Auto Leasing on December 31, 2021.

e. Prepare the appropriate entries for Anything Grows and Mid-South on September 29, 2023, assuming the purchase option was exercised on that date.

Answers: 1

Another question on Business

Business, 22.06.2019 08:40

The following selected circumstances relate to pending lawsuits for erismus, inc. erismus’s fiscal year ends on december 31. financial statements are issued in march 2019. erismus prepares its financial statements according to u.s. gaap. required: indicate the amount erismus would record as an asset, liability, or not accrued in the following circumstances. 1. erismus is defending against a lawsuit. erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000. 4. erismus is a plaintiff in a lawsuit. erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000. 5. erismus is a plaintiff in a lawsuit. erismus’s management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000.

Answers: 1

Business, 22.06.2019 11:50

The basic difference between macroeconomics and microeconomics is that: a. microeconomics looks at the forest (aggregate markets) while macroeconomics looks at the trees (individual markets). b. macroeconomics is concerned with groups of individuals while microeconomics is concerned with single countries. c. microeconomics is concerned with the trees (individual markets) while macroeconomics is concerned with the forest (aggregate markets). d. macroeconomics is concerned with generalization while microeconomics is concerned with specialization.

Answers: 3

Business, 22.06.2019 18:00

Rosie and her brother michael decided recently to purchase an rv together. they both want to use the rv to take their families camping. the price of the rv was $10,000. since michael expects to use the rv 60% of the time and rosie 40% of the time, michael contributed $6,000 and rosie contributed $4,000. their ownership percentage equals their contribution percentage. which type of property titling should they use to reflect their ownership interest?

Answers: 1

Business, 23.06.2019 00:00

Which of the following statements is correct? a major disadvantage of a partnership relative to a corporation is the fact that federal income taxes must be paid by the partners rather than by the firm itself. in a typical partnership, liability for other partners’ misdeeds is limited to the amount of a particular partner’s investment in the business.true in a limited partnership, the limited partners have voting control, while the general partner has operating control over the business, and the limited partners are individually responsible, on a pro rata basis, for the firm’s debts in the event of bankruptcy. partnerships have more difficulty attracting large amounts of capital than corporations because of such factors as unlimited liability, the need to reorganize when a partner dies, and the illiquidity of partnership interests.

Answers: 1

You know the right answer?

The lease agreement specified quarterly payments of $6,500 beginning September 30, 2021, the beginni...

Questions

Mathematics, 20.02.2020 04:44

Mathematics, 20.02.2020 04:45

Computers and Technology, 20.02.2020 04:45

Mathematics, 20.02.2020 04:45

Mathematics, 20.02.2020 04:45

Mathematics, 20.02.2020 04:45

Social Studies, 20.02.2020 04:46

![\left[\begin{array}{cccccc}Time&Beg&Cuota&Interest&Amort&Ending\\0&75760&6500&&6500&69260\\1&69260&6500&2078&4422&64838\\2&64838&6500&1945&4555&60283\\3&60283&6500&1808&4692&55591\\4&55591&6500&1668&4832&50759\\5&50759&6500&1523&4977&45782\\6&45782&6500&1373&5127&40655\\7&40655&6500&1220&5280&35375\\8&35375&6500&1061&5439&29936\\9&29936&6500&898&5602&24334\\10&24334&6500&730&5770&18564\\11&18564&6500&557&5943&12621\\12&12621&13000&379&12621&0\\\end{array}\right]](/tpl/images/0810/9262/66f64.png)