Business, 19.10.2020 21:01 xeskimopie

Assume that on January 1, 2012, a parent company acquired a 70% interest in a subsidiary's voting common stock. On the date of acquisition, the fair value of the subsidiary's net assets equaled their reported book values except for machinery and equipment, which had a fair value of $480,000 and a reported book value of $250,000. The machinery and equipment had a 5 year remaining useful life and no salvage value. The following are the highly summarized pre-consolidation income statements of the parent and subsidiary for the year ended December 31 , 2013:

Income Statement Parent Subsidiary

Revenues $2,160,000 $288,000

Equity income 60,200

Expenses 1440000 144,000

Net income $780,200 144,000

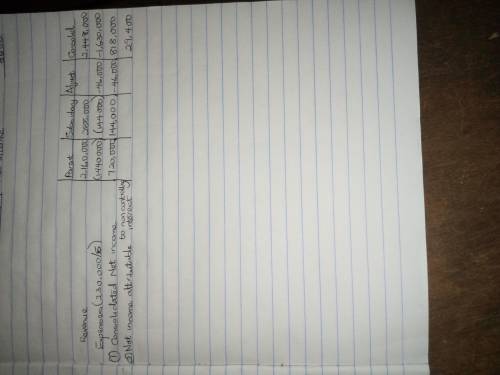

For the year ended December 31, 2013, what amounts will be reported for (1) consolidated net income and (2) net income attributable to the non-controlling interest, respectively, in the parent's consolidated financial statements?

Answers: 2

Another question on Business

Business, 22.06.2019 03:30

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

Business, 22.06.2019 14:00

Which of the following would not generally be a motive for a firm to hold inventories? a. to decouple or separate parts of the production process b. to provide a stock of goods that will provide a selection for customers c. to take advantage of quantity discounts d. to minimize holding costs e. all of the above are functions of inventory.

Answers: 1

Business, 22.06.2019 19:20

Royal motor corp. generates a major portion of its revenues by manufacturing luxury sports cars. however, the company also derives an insignificant percent of its annual revenues by selling its sports merchandise that includes apparel, shoes, and other accessories under the same brand name. which of the following terms best describes royal motor corp.? a. aconglomerate b. a subsidiary c. adominant-businessfirm d. a single-business firm

Answers: 1

Business, 22.06.2019 20:10

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

You know the right answer?

Assume that on January 1, 2012, a parent company acquired a 70% interest in a subsidiary's voting co...

Questions

English, 18.08.2019 12:10

Mathematics, 18.08.2019 12:10

Biology, 18.08.2019 12:10

History, 18.08.2019 12:10

Mathematics, 18.08.2019 12:10

Social Studies, 18.08.2019 12:10

Mathematics, 18.08.2019 12:10

History, 18.08.2019 12:10

Mathematics, 18.08.2019 12:10

Social Studies, 18.08.2019 12:10

Mathematics, 18.08.2019 12:10

English, 18.08.2019 12:10