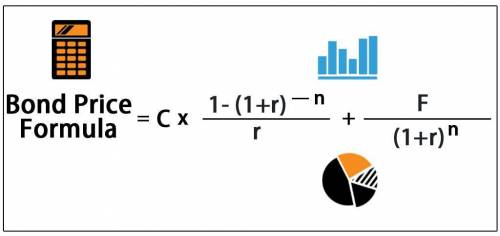

Your firm has a credit rating of BBB. You notice the credit spread for 5yr maturity BBB debt is 1.1% or 110 basis points. Your firm's 5yr debt has a coupon rate of 6% with annual payments. You see that new 5yr Treasury bonds are being issued at par with a coupon rate of 2.6%. What should the price of your outstanding 5yr bonds be per $100 face value? a. $110.33.b. $115.75.c. $123.71.d. $112.54.

Answers: 3

Another question on Business

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 22.06.2019 16:50

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

Business, 23.06.2019 01:00

What are the benefits of different types of career education, like community colleges, vocational training programs, and four-year colleges?

Answers: 3

You know the right answer?

Your firm has a credit rating of BBB. You notice the credit spread for 5yr maturity BBB debt is 1.1%...

Questions

History, 19.09.2020 01:01

Biology, 19.09.2020 01:01

Mathematics, 19.09.2020 01:01

Mathematics, 19.09.2020 01:01

Mathematics, 19.09.2020 01:01

Mathematics, 19.09.2020 01:01

Biology, 19.09.2020 01:01

Mathematics, 19.09.2020 01:01

Mathematics, 19.09.2020 01:01

Social Studies, 19.09.2020 01:01