Business, 22.10.2020 01:01 skincarewithcourtney

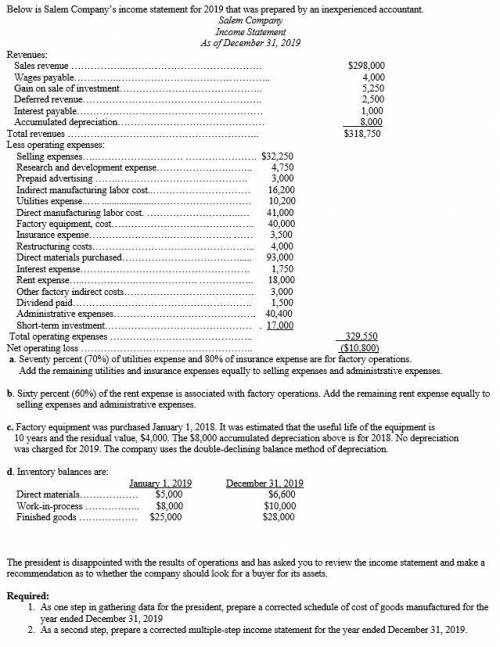

Below is Salem Company’s income statement for 2018 that was prepared by an inexperienced accountant. Salem Company Income Statement As of December 31, 2018 Revenues: Sales revenue ……………..…………………………………… $298,000 Wages payable…………..……………………………………….. 4,000 Gain on sale of investment…………………………………….. 5,250 Deferred revenue………………………………………………. 2,500 Interest payable………………………………………………… 1,000 Accumulated depreciation……………………………………… 10,000 Total revenues ………………………………………………….. $320,750 Less operating expenses: Selling expenses….……………………… …………………. $32,250 Research and development expense………………….…….. 4,750 Prepaid advertising …….…………………………………. 3,000 Indirect manufacturing labor cost..………………………… 16,200 Utilities expense..…. .………………………… 10,200 Direct manufacturing labor cost. ………………………..… 41,000 Factory equipment………………………………………….. 40,000 Insurance expense…………………….………………. …… 3,500 Restructuring costs………………………………………….. 4,000 Direct materials purchased………………………………. 93,000 Interest expense……………………………………………. 1,750 Rent expense…..…………….………………. …………….. 18,000 Other factory indirect costs…………………………………. 3,000 Dividend paid………………………………………………. 1,500 Administrative expenses………………….…………………. 40,400 Short-term investment……………………………………… . 19,000 Total operating expenses …………………………………….. 331,550 Net operating loss …………………………………………….. ($10,800) a. Seventy percent (70%) of utilities expense and 80% of insurance expense are for factory operations. Apply the remaining utilities and insurance expenses equally to selling expense and administrative expenses. b. Sixty percent (60%) of the rent expense is associated with factory operations. Allocate the remaining rent equally to selling expense and administrative expenses. c. Factory equipment was purchased January 1, 2017. It was estimated that the useful life of the equipment is 10 years and the residual value, $4,000. The $10,000 accumulated depreciation above is for 2017. No depreciation was charged for 2018. The company uses the double-declining balance method of depreciation. d. Inventory balances are: January 1, 2018 December 31, 2018 Direct materials……………… $5,000 $6,600 Work-in-process …………….. $8,000 $10,000 Finished goods ……………… $25,000 $28,000 e. The company’s tax rate is 21%. The president is disappointed with the results of operations and has asked you to review the income statement and make a recommendation as to whether the company should look for a buyer for its assets. Required: 1. As one step in gathering data for the president, prepare a corrected schedule of cost of goods manufactured for the year ended December 31, 2018. 2. As a second step, prepare a new multiple-step income statement for the year ended December 31, 2018. 3. Calculate the cost of producing one unit if the company produced 120,000 units in 2018 (round your answer to two decimal points).

Answers: 2

Another question on Business

Business, 21.06.2019 17:30

Which composition of transformations will create a pair of similar, not congruent triangles? a rotation, then a reflectiona translation, then a rotationa reflection, then a translationa rotation, then a dilationmark this and retumsave and exit

Answers: 2

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 05:00

Which of the following differentiates cost accounting and financial accounting? a. the primary users of cost accounting are the investors, whereas the primary users of financial accounting are the managers. b. cost accounting measures only the financial information related to the costs of acquiring fixed assets in an organization, whereas financial accounting measures financial and nonfinancial information of a company's business transactions. c. cost accounting measures information related to the costs of acquiring or using resources in an organization, whereas financial accounting measures a financial position of a company to investors, banks, and external parties. d. cost accounting deals with product design, production, and marketing strategies, whereas financial accounting deals mainly with pricing of the products.

Answers: 3

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

You know the right answer?

Below is Salem Company’s income statement for 2018 that was prepared by an inexperienced accountant....

Questions

Mathematics, 16.08.2021 19:50

Mathematics, 16.08.2021 19:50

Mathematics, 16.08.2021 20:00

English, 16.08.2021 20:00

English, 16.08.2021 20:00

Chemistry, 16.08.2021 20:00

Mathematics, 16.08.2021 20:00

Health, 16.08.2021 20:00