Answers: 3

Another question on Business

Business, 21.06.2019 20:40

Astock is selling today for $50 per share. at the end of the year, it pays a dividend of $3 per share and sells for $58. a. what is the total rate of return on the stock? (enter your answer as a whole percent.) b. what are the dividend yield and percentage capital gain? (enter your answers as a whole percent.) c. now suppose the year-end stock price after the dividend is paid is $42. what are the dividend yield and percentage capital gain in this case? (negative amounts should be indicated by a minus sign. enter your answers as a whole percent.)

Answers: 1

Business, 22.06.2019 10:20

Sye chase started and operated a small family architectural firm in 2016. the firm was affected by two events: (1) chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. there were $250 of supplies on hand as of december 31, 2016. record the two transactions in the accounts. record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. post the entries in the t-accounts and prepare a post-closing trial balance.

Answers: 1

Business, 23.06.2019 02:00

You are considering the purchase of one of two machines used in your manufacturing plant. machine 1 has a life of two years, costs $20,000 initially, and then $4,000 per year in maintenance costs. machine 2 costs $25,000 initially, has a life of three years, and requires $3,500 in annual maintenance costs. either machine must be replaced at the end of its life with an equivalent machine. using eac which is the better machine for the firm

Answers: 1

Business, 23.06.2019 10:00

In two or three sentences describe how open market operations change the money suppy

Answers: 3

You know the right answer?

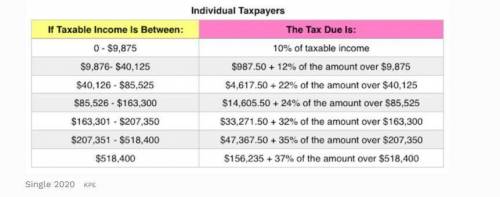

Marc, a single taxpayer, earns $60,000 in taxable income and $5,000 in interest from an investment i...

Questions

Mathematics, 12.12.2020 17:00

Arts, 12.12.2020 17:00

English, 12.12.2020 17:00

History, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

English, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

History, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

History, 12.12.2020 17:00