Business, 24.10.2020 07:00 sofiisabella10

Please please help me i have exam now

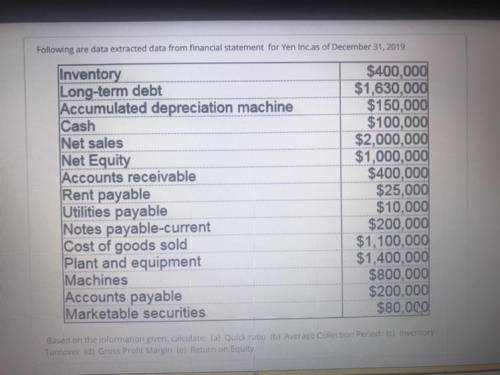

Following are data extracted data from financial statement for Yen Inc. as of December 31, 2019

Inventory

Long-term debt

Accumulated depreciation machine

Cash

Net sales

Net Equity

Accounts receivable

Rent payable

Utilities payable

Notes payable-current

Cost of goods sold

Plant and equipment

Machines

Accounts payable

Marketable securities

$400,000

$1,630,000

$150,000

$100,000

$2,000,000

$1,000,000

$400,000

$25,000

$10,000

$200,000

$1,100,000

$1,400,000

$800,000

$200,000

$80,000

Based on the information given, calculate: (a) Quick ratio (b) Average Collection Period () Inventory

Turnover (d) Gross Profit Margin (e) Return on Equity

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

The cost of capital: introduction the cost of capital: introduction companies issue bonds, preferred stock, and common equity to aise capital to invest in capital budgeting projects. capital is』necessary factor of production and like any other factor, it has a cost. this cost is equal to the select the applicable security. the rates of return that investors require on bonds, preferred stocks, and common equity represent the costs of those securities to the firm. companies estimate the required returns on their securities, calculate a weighted average of the costs of their different types of capital, and use this average cost for capital budgeting purposes. required return on rate: when calculating om operations when the firm's primary financial objective is to select shareholder value. to do this, companies invest in projects that earnselect their cost of capital. so, the cost of capital is often referred to as the -select -select and accruals, which a se spontaneously we hted average cost of capital wa c our concern is with capital that must be provided by select- 쑤 interest-bearing debt preferred stock and common equity. capital budgeting projects are undertaken, are not included as part of total invested capital because they do not come directly from investors. which of the following would be included in the caculation of total invested capital? choose the response that is most correct a. notes payable b. taxes payable c retained earnings d. responses a and c would be included in the calculation of total invested capital. e. none of the above would be included in the cakulation of total invested capital.

Answers: 2

Business, 22.06.2019 07:00

For the past six years, the price of slippery rock stock has been increasing at a rate of 8.21 percent a year. currently, the stock is priced at $43.40 a share and has a required return of 11.65 percent. what is the dividend yield? 3.20 percent 2.75 percent 3.69 percent

Answers: 3

Business, 23.06.2019 03:20

Draw, label and explain the circular flow model (cfm). include the following: firms, households, product market, and factor (or resource) market.who owns the productive resources? what are those resources? what payment does each type of resource earn? explain the two markets in the cfm and explain the roles that firms and household each play in the cfm.

Answers: 2

You know the right answer?

Please please help me i have exam now

Following are data extracted data from financial statement fo...

Questions

History, 30.10.2021 19:10

Social Studies, 30.10.2021 19:10

Mathematics, 30.10.2021 19:10

History, 30.10.2021 19:10

Arts, 30.10.2021 19:10

Mathematics, 30.10.2021 19:10

Mathematics, 30.10.2021 19:10

Business, 30.10.2021 19:10

Mathematics, 30.10.2021 19:10

English, 30.10.2021 19:10