Business, 30.10.2020 17:00 Cupcake589

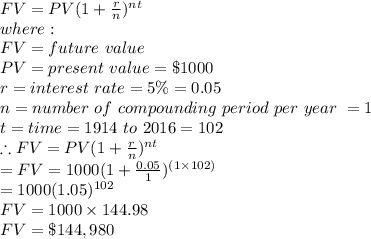

Compound Interest (LO1) Suppose that the value of an investment in the stock market has increased at an average compound rate of about 5% since 1914. It is now 2016. If someone invested $1,000 in 1914, how much would that investment be worth today?

Answers: 1

Another question on Business

Business, 21.06.2019 22:50

What happens when a bank is required to hold more money in reserve?

Answers: 3

Business, 22.06.2019 02:10

Materials purchases (on credit). direct materials used in production. direct labor paid and assigned to work in process inventory. indirect labor paid and assigned to factory overhead. overhead costs applied to work in process inventory. actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) transfer of jobs 306 and 307 to finished goods inventory. cost of goods sold for job 306. revenue from the sale of job 306. assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions.

Answers: 1

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 11:20

Security a has a higher standard deviation of returns than security b. we would expect that: (i) security a would have a risk premium equal to security b. (ii) the likely range of returns for security a in any given year would be higher than the likely range of returns for security b. (iii) the sharpe ratio of a will be higher than the sharpe ratio of b. (a) i only (b) i and ii only (c) ii and iii only (d) i, ii and iii

Answers: 1

You know the right answer?

Compound Interest (LO1) Suppose that the value of an investment in the stock market has increased at...

Questions

English, 30.08.2021 06:20

Mathematics, 30.08.2021 06:20

Mathematics, 30.08.2021 06:20

Social Studies, 30.08.2021 06:20

Mathematics, 30.08.2021 06:20

Health, 30.08.2021 06:20

Mathematics, 30.08.2021 06:20

Spanish, 30.08.2021 06:20

Mathematics, 30.08.2021 06:20

Mathematics, 30.08.2021 06:20

English, 30.08.2021 06:20

Mathematics, 30.08.2021 06:30

Mathematics, 30.08.2021 06:30

Mathematics, 30.08.2021 06:30