Business, 02.11.2020 16:30 alexmoy45p8yd7v

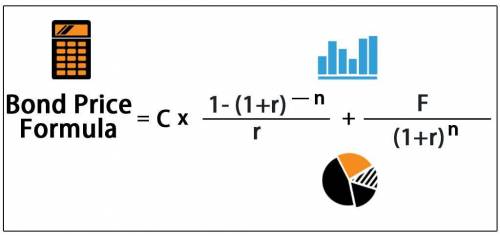

The Whitesell Athletic Corporation's bonds have a face value of $1,000 and a 10% coupon paid semi-annually. The bonds mature in 10 years. If the yield to maturity (YTM) is 7%, what will the bond sell for

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 11:40

Jamie is saving for a trip to europe. she has an existing savings account that earns 3 percent annual interest and has a current balance of $4,200. jamie doesn’t want to use her current savings for vacation, so she decides to borrow the $1,600 she needs for travel expenses. she will repay the loan in exactly one year. the annual interest rate is 6 percent. a. if jamie were to withdraw the $1,600 from her savings account to finance the trip, how much interest would she forgo? .b. if jamie borrows the $1,600 how much will she pay in interest? c. how much does the trip cost her if she borrows rather than dip into her savings?

Answers: 1

Business, 22.06.2019 17:00

Dan wants to start a supermarket in his hometown, and wants to get into the business only after finding out about the market and how successful his business might be. the best way for dan to gain knowledge is to:

Answers: 2

Business, 22.06.2019 18:00

If you would like to ask a question you will have to spend some points

Answers: 1

You know the right answer?

The Whitesell Athletic Corporation's bonds have a face value of $1,000 and a 10% coupon paid semi-an...

Questions

Mathematics, 12.10.2020 01:01

Mathematics, 12.10.2020 01:01

Mathematics, 12.10.2020 01:01

Mathematics, 12.10.2020 01:01

Health, 12.10.2020 01:01

Mathematics, 12.10.2020 01:01

Mathematics, 12.10.2020 01:01

Mathematics, 12.10.2020 01:01