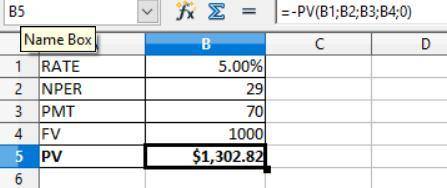

Leggio Inc. issued bonds with a 30-year maturity one year ago. The bonds have a 7% coupon, make one payment per year, and sold at their $1,000 par value at issue because the going market rate at the time was 7%. Now, one year later, the market rate has declined from 7% to 5%. At what price should Leggio's bonds now sell?

Answers: 2

Another question on Business

Business, 22.06.2019 01:40

Select the word from the list that best fits the definition sometimes

Answers: 2

Business, 22.06.2019 14:20

For the year ended december 31, a company has revenues of $323,000 and expenses of $199,000. the company paid $52,400 in dividends during the year. the balance in the retained earnings account before closing is $87,000. which of the following entries would be used to close the dividends account?

Answers: 3

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

Business, 23.06.2019 00:50

Amanufacturing firm is considering overhauling the existing compensation strategy. currently every front line employee who works on the assembly line earns the same hourly wage. ideally, management would like to institute a new pay system that involves pay-for-performance. which of the following recommendations is both consistent with scientific management's general emphases and generally good advice for management of this firma. the firm should adopt a differential pay system with one pay level for average performance, and a higher level for good performance. b. the firm should adopt a differential pay system, but the firm should modify it from its original design and provide many different levels of pay associated with different performance levels. c. the firm should understand worker psychology and to focus on pay as the key motivator. d. all of the abovee. none of the above

Answers: 1

You know the right answer?

Leggio Inc. issued bonds with a 30-year maturity one year ago. The bonds have a 7% coupon, make one...

Questions

Mathematics, 26.07.2021 21:50

Physics, 26.07.2021 21:50

History, 26.07.2021 21:50

English, 26.07.2021 21:50

Mathematics, 26.07.2021 21:50

English, 26.07.2021 21:50

Mathematics, 26.07.2021 21:50