Start period 02/01/2019

End period 02152019

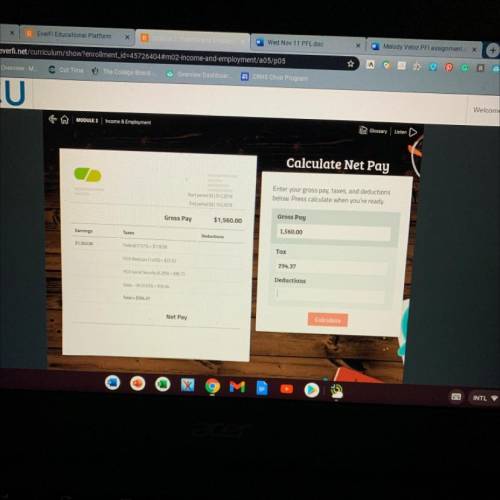

Enter your gross pay, taxes, and deductions

...

Start period 02/01/2019

End period 02152019

Enter your gross pay, taxes, and deductions

below. Press calculate when you're ready.

Gross Pay

$1,560.00

Earnings

1,560.00

Taxes

Federal (7.57%) = $118.09

Tax

FICA Medicare (1.45%) = $22.62

FICA Social Security (6.20%) = $96.72

State-OK (3.65%) = $56.94

Total = $294.37

What is the deductions?

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

Factors like the unemployment rate,the stock market,global trade,economic policy,and the economic situation of other countries have no influence on the financial status of individuals. true or false

Answers: 1

Business, 22.06.2019 18:00

Rosie and her brother michael decided recently to purchase an rv together. they both want to use the rv to take their families camping. the price of the rv was $10,000. since michael expects to use the rv 60% of the time and rosie 40% of the time, michael contributed $6,000 and rosie contributed $4,000. their ownership percentage equals their contribution percentage. which type of property titling should they use to reflect their ownership interest?

Answers: 1

Business, 22.06.2019 20:30

Identify the level of the literature hierarchy for u.s. gaap to which each item belongs

Answers: 1

Business, 22.06.2019 21:20

Label each of the following statements true, false, or uncertain. explain your choice carefully. a. workers benefit equally from the process of creative destruction. b. in the past two decades, the real wages of low-skill u.s. workers have declined relative to the real wages of high-skill workers. c. technological progress leads to a decrease in employment if, and only if, the increase in output is smaller than the increase in productivity. d. the apparent decrease in the natural rate of unemployment in the united states in the second-half of the 1990s can be explained by the fact that productivity growth was unexpectedly high during that period.

Answers: 3

You know the right answer?

Questions

Mathematics, 15.03.2020 22:05

Mathematics, 15.03.2020 22:05

Mathematics, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Computers and Technology, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Mathematics, 15.03.2020 22:06

Chemistry, 15.03.2020 22:06