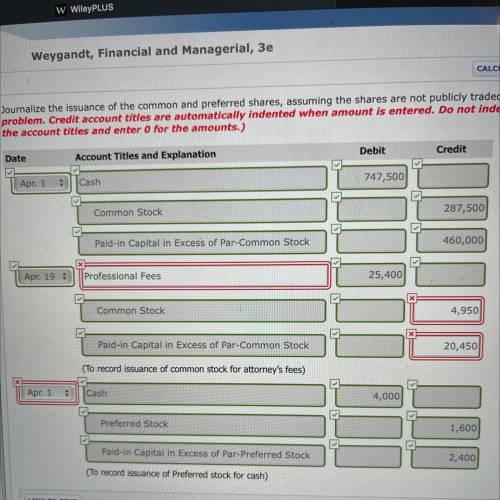

Marigold Corp. began operations on April 1 by issuing 57,500 shares of $5 par value common stock for cash at $13 per share. On April 19, it issued 1,650 shares of common

stock to attorneys in settlement of their bill of $25,400 for organization costs. In addition, Marigold issued 800 shares of $2 par value preferred stock for $5 cash per share.

Journalize the issuance of the common and preferred shares, assuming the shares are not publicly traded

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

Business, 22.06.2019 11:00

Companies hd and ld are both profitable, and they have the same total assets (ta), total invested capital, sales (s), return on assets (roa), and profit margin (pm). both firms finance using only debt and common equity. however, company hd has the higher total debt to total capital ratio. which of the following statements is correct? a) company hd has a higher assets turnover than company ld. b) company hd has a higher return on equity than company ld. c) none of the other statements are correct because the information provided on the question is not enough. d) company hd has lower total assets turnover than company ld. e) company hd has a lower operating income (ebit) than company ld

Answers: 2

Business, 22.06.2019 14:30

Your own record of all your transactions. a. check register b. account statement

Answers: 1

Business, 22.06.2019 20:00

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

You know the right answer?

Marigold Corp. began operations on April 1 by issuing 57,500 shares of $5 par value common stock for...

Questions

Mathematics, 04.10.2019 21:50

Geography, 04.10.2019 21:50

History, 04.10.2019 21:50

Social Studies, 04.10.2019 21:50

History, 04.10.2019 21:50

Mathematics, 04.10.2019 21:50

World Languages, 04.10.2019 21:50

Mathematics, 04.10.2019 21:50

Computers and Technology, 04.10.2019 21:50

History, 04.10.2019 21:50

Chemistry, 04.10.2019 21:50

Business, 04.10.2019 21:50

Biology, 04.10.2019 21:50