Business, 01.12.2020 02:10 kingalex7575

Suppose that in a country politicians feel that interest rates are too high and they advocate a greater rate of growth of the money supply to decrease the interest rate.

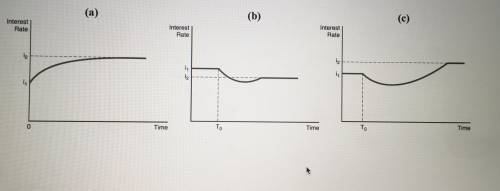

Figure (a) illustrates the effect of an increased rate of money supply growth at time period 0.

Figures (b) and (c) illustrate the effect of an increased rate of money supply growth at time period T0.

i) If a decline in interest rates is desired, in which case (a, b or c) an increase in money supply growth should be called for? Explain, why?

ii) In which case (a, b or c) a decrease in money growth is appropriate to decrease the interest rate immediately? Explain, why?

iii) If the policymakers care more about the low interest rates in the long-run, in which case (a, b or c) a decrease in money growth is appropriate? Explain, why?

Answers: 1

Another question on Business

Business, 22.06.2019 03:40

Apharmaceutical packaging company (ppc) has decided to reorganize its processes into cells. the company has four different production operations, each requiring a unique piece of equipment. the names and functions of the four pieces of equipment are sort, count, place, and package. the company packages five different families of products (a, b, c, d, and e). the tables below indicate the demand (total units/day by product family), required operations, and operation cycle times for each product family. assume that any individual piece of equipment is available to operate 16 hours/day, but 2 hours (in total) are lost each day on each piece of equipment due to breaks and meetings when operators are not available to operate the equipment. how many minutes/day are available for production

Answers: 3

Business, 22.06.2019 06:10

Information on gerken power co., is shown below. assume the company’s tax rate is 40 percent. debt: 9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments. common stock: 219,000 shares outstanding, selling for $83.90 per share; beta is 1.24. preferred stock: 12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share. market: 7.2 percent market risk premium and 5 percent risk-free rate. required: calculate the company's wacc. (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) wacc %

Answers: 2

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 22.06.2019 11:30

Buyer henry is going to accept seller shannon's $282,500 counteroffer. when will this counteroffer become a contract. a. counteroffers cannot become contracts b. when henry gives shannon notice of the acceptance c. when henry signs the counteroffer d. when shannon first made the counteroffer

Answers: 3

You know the right answer?

Suppose that in a country politicians feel that interest rates are too high and they advocate a grea...

Questions

History, 27.06.2019 07:30

History, 27.06.2019 07:30

History, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30

History, 27.06.2019 07:30

English, 27.06.2019 07:30

History, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30

History, 27.06.2019 07:30

Physics, 27.06.2019 07:30