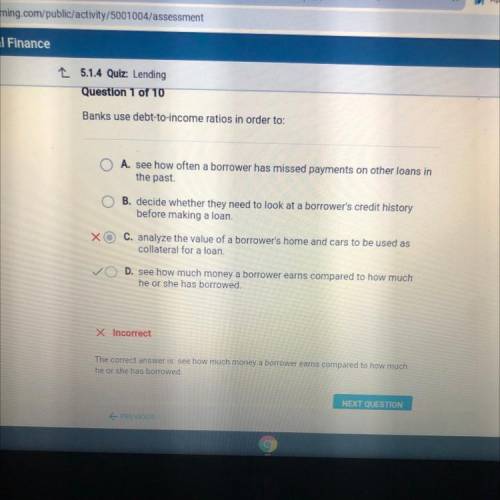

Banks use debt-to-income ratios in order to:

A. see how often a borrower has missed payments on other loans in

the past.

B. decide whether they need to look at a borrower's credit history

before making a loan.

C. analyze the value of a borrower's home and cars to be used as

collateral for a loan.

D. see how much money a borrower earns compared to how much

he or she has borrowed.

Answers: 2

Another question on Business

Business, 22.06.2019 16:00

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 21:40

Heather has been an active participant in a defined benefit plan for 19 years. during her last 6 years of employment, heather earned $42,000, $48,000, $56,000, $80,000, $89,000, and $108,000, respectively (representing her highest-income years). calculate heather’s maximum allowable benefits from her qualified plan (assume that there are fewer than 100 participants). assume that heather’s average compensation for her three highest years is $199,700. calculate her maximum allowable benefits.

Answers: 3

Business, 23.06.2019 03:00

You are considering purchasing a company — assets, liabilities, warts, and all. you are aware that sometimes liabilities do not always show up on the balance sheet. discuss five examples of liabilities that may not be explicitly recognized on the balance sheet, making sure to explain why they are liabilities.

Answers: 1

You know the right answer?

Banks use debt-to-income ratios in order to:

A. see how often a borrower has missed payments on oth...

Questions

History, 13.11.2019 00:31

English, 13.11.2019 00:31

Biology, 13.11.2019 00:31

Mathematics, 13.11.2019 00:31

Mathematics, 13.11.2019 00:31

English, 13.11.2019 00:31

Physics, 13.11.2019 00:31