Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to produce and sell one type of carburetor to Troy Engines Ltd. for a cost of $55 per unit. To evaluate this offer, Troy Engines Ltd. has gathered the following information relating to its own cost of producing the carburetor internally:

Direct materials cost $34 per unit.

Troy Engines pays its direct labour employees $20 per hour; each carburetor requires 30 minutes of labour time.

Variable manufacturing overhead is allocated at 30% of direct labour cost.

Total fixed manufacturing cost amounts to $15 per unit, of which 60% is allocated common cost and the remaining 40% covers depreciation of special equipment and supervisory salaries. The special equipment has no resale value. Supervisory personnel will be transferred to a different department if the company decides to purchase the carburetor from the outside supplier.

Yearly production of this type of carburetor is 17,000 units.

Required:

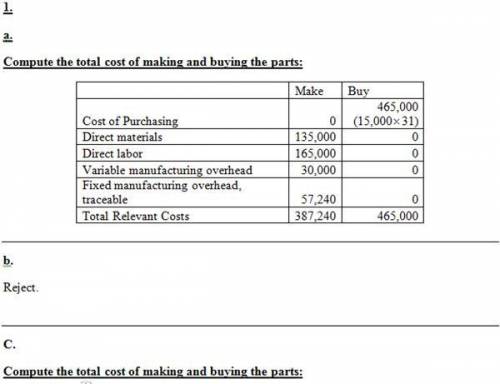

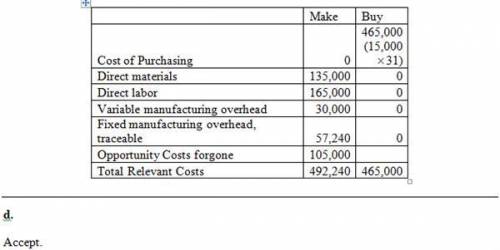

1-a. Assume that the company has no alternative use for the facilities that are now being used to produce the carburetors. Compute the total differential cost per unit for producing and buying the product.

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

In order to minimize project risk which step comes after the step of identifying risks

Answers: 1

Business, 21.06.2019 22:10

Uestion 7 you hold a portfolio consisting of a $5,000 investment in each of 20 different stocks. the portfolio beta is equal to 1.12. you have decided to sell a coal mining stock (b = 1.00) at $5,000 net and use the proceeds to buy a like amount of a mineral rights company stock (b = 2.00). what is the new beta of the portfolio?

Answers: 3

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 13:50

Which one of the following statements is true? ddt does not prevent disease from passing from agricultural animals to humans. cost was a major factor in the united states government's decision to ban ddt. many african governments concluded that the potential long-term health effects of ddt were not as serious as the immediate problem of insect control. ddt cannot accumulate in the fat of animals. the ddt ban in the united states has made it very difficult to control agricultural insect pests.

Answers: 3

You know the right answer?

Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company has alwa...

Questions

Social Studies, 07.12.2021 07:20

Mathematics, 07.12.2021 07:20

Mathematics, 07.12.2021 07:20

History, 07.12.2021 07:20

Computers and Technology, 07.12.2021 07:20

Mathematics, 07.12.2021 07:20