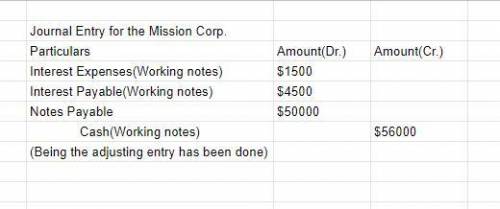

Mission Corp. borrowed $50,000 cash on April 1, 2019, and signed a one-year 12% interest-bearing note payable. The interest and principal are both due on March 31, 2020. 20) Assume that the appropriate adjusting entry was made on December 31, 2019 and that no adjusting entries have been made during 2020. Which of the following would be the required journal entry to pay the entire amount due on March 31, 2020? A) Interest expense XXXNotes payable XXXInterest payable XXXCash XXXB) Interest expense XXX Interest payable XXX Note payable XXX Cash XXX

Answers: 1

Another question on Business

Business, 22.06.2019 11:50

The smelting department of kiner company has the following production and cost data for november. production: beginning work in process 3,700 units that are 100% complete as to materials and 23% complete as to conversion costs; units transferred out 10,500 units; and ending work in process 8,100 units that are 100% complete as to materials and 41% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs for the month of november. materials conversion costs total equivalent units

Answers: 1

Business, 22.06.2019 16:40

An electronics store is running a promotion where for every video game purchased, the customer receives a coupon upon checkout to purchase a second game at a 50% discount. the coupons expire in one year. the store normally recognized a gross profit margin of 40% of the selling price on video games. how would the store account for a purchase using the discount coupon?

Answers: 3

Business, 22.06.2019 20:20

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments.a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

Business, 22.06.2019 22:00

Miami incorporated estimates that its retained earnings break point (bpre) is $21 million, and its wacc is 13.40 percent if common equity comes from retained earnings. however, if the company issues new stock to raise new common equity, it estimates that its wacc will rise to 13.88 percent. the company is considering the following investment projects: project size irr a $4 million 14.00% b 5 million 15.10 c 4 million 16.20 d 6 million 14.20 e 1 million 13.42 f 6 million 13.75 what is the firm's optimal capital budget?

Answers: 3

You know the right answer?

Mission Corp. borrowed $50,000 cash on April 1, 2019, and signed a one-year 12% interest-bearing not...

Questions

Social Studies, 12.03.2021 05:40

History, 12.03.2021 05:40

Mathematics, 12.03.2021 05:40

Chemistry, 12.03.2021 05:40

Mathematics, 12.03.2021 05:40

Biology, 12.03.2021 05:40

Mathematics, 12.03.2021 05:40

Advanced Placement (AP), 12.03.2021 05:40

Computers and Technology, 12.03.2021 05:40

Mathematics, 12.03.2021 05:40

Mathematics, 12.03.2021 05:40

Mathematics, 12.03.2021 05:40