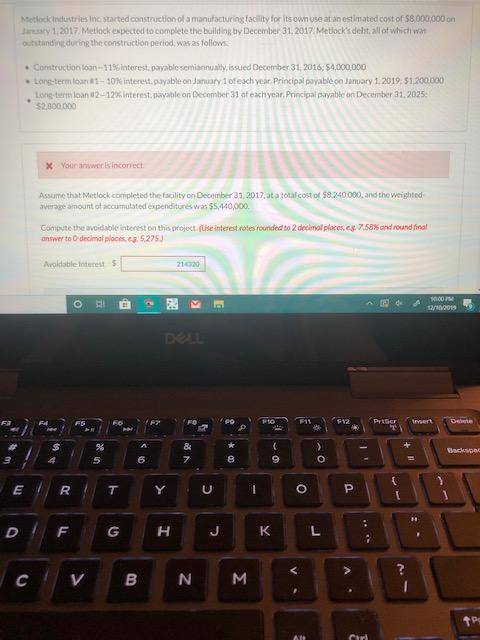

Metlock Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $8,000,000 on January 1, 2017. Metlock expected to complete the building by December 31, 2017. Metlock’s debt, all of which was outstanding during the construction period, was as follows.

Answers: 3

Another question on Business

Business, 21.06.2019 20:00

Which of the following statements is true about financial planning

Answers: 2

Business, 21.06.2019 22:10

Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $71,300. in determining her taxable self-employment income for the oasdi tax, how much of her net self-employment earnings must fess count? a. $74,500 b. $71,300 c. $53,900 d. $127,200 e. none of the above.

Answers: 3

Business, 22.06.2019 05:20

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

Business, 22.06.2019 07:30

Why has the free enterprise system been modified to include some government intervention?

Answers: 1

You know the right answer?

Metlock Industries Inc. started construction of a manufacturing facility for its own use at an estim...

Questions

Mathematics, 25.09.2019 12:50

Computers and Technology, 25.09.2019 12:50

Mathematics, 25.09.2019 12:50

Health, 25.09.2019 12:50

Mathematics, 25.09.2019 12:50

History, 25.09.2019 12:50

Geography, 25.09.2019 12:50

Mathematics, 25.09.2019 12:50

Social Studies, 25.09.2019 12:50

Mathematics, 25.09.2019 12:50