A new surgical facility called Cut & Sew is opening in neighborhoods throughout the United States. They are job shops that handle a variety of outpatient surgical procedures. Their process is set up so that one doctor cuts and the other sews. They have five patients to sequence for tomorrow. Since the weather forecast is for a cool and sunny day, they would also like to play golf tomorrow. They want to sequence their patients with the objective of minimizing the time from the beginning of the first job until the finish of that job. The patients and estimated times are as follows:

Patient Cut Time (hours) Sew Time (hours)

A 2.3 2.8

B 2.5 3

C 2 1.5

D 0.6 1

E 3.6 2.6

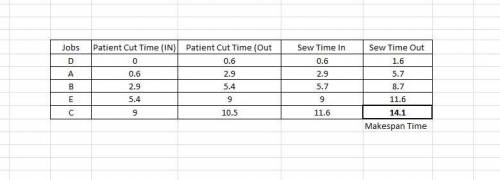

Sequence the patients using Johnson's Method, state the schedule for each operation, and determine the minimum makespan.

Answers: 3

Another question on Business

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

Business, 22.06.2019 11:00

Samantha is interested in setting up her own accounting firm and wants to specialize in the area of accounting that has experienced the most significant growth in recent years. which area of accounting should she choose as her specialty? samantha should choose as her specialty.

Answers: 1

Business, 23.06.2019 02:30

George retired from a local law firm and then volunteered to oversee a nonprofit's legal records. george is performing the duties of a:

Answers: 1

Business, 23.06.2019 12:30

Mason farms purchased a building for $689,000 eight years ago. six years ago, repairs costing $136,000 were made to the building. the annual taxes on the property are $11,000. the building has a current market value of $840,000 and a current book value of $494,000. the building is totally paid for and solely owned by the firm. if the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? $0$582,000$840,000$865,000$953,000

Answers: 3

You know the right answer?

A new surgical facility called Cut & Sew is opening in neighborhoods throughout the United State...

Questions

Computers and Technology, 13.08.2019 04:30

Biology, 13.08.2019 04:30

Mathematics, 13.08.2019 04:30

Spanish, 13.08.2019 04:30

History, 13.08.2019 04:30

Chemistry, 13.08.2019 04:30