Business, 18.01.2021 21:00 lelliott86

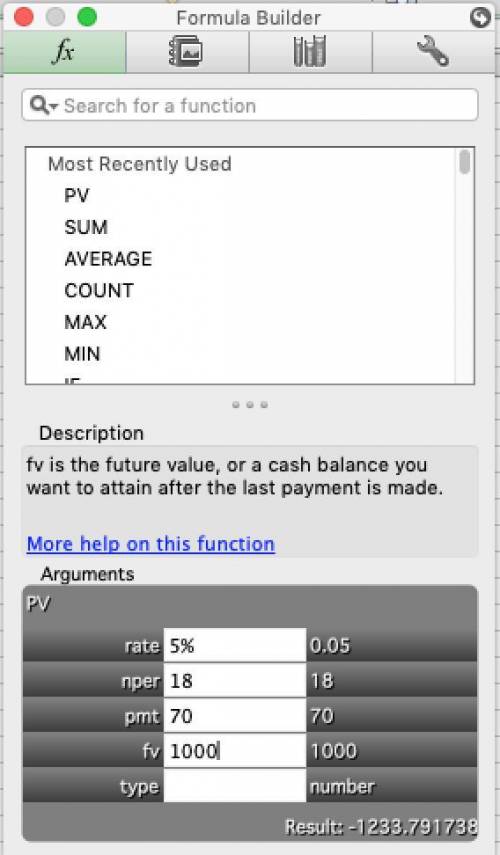

Assume that Bunch Inc. has an issue of 18-year $1,000 par value bonds that pay 7% interest, annually. Further assume that today's expected rate of return on these bonds is 5%. How much would these bonds sell for today

Answers: 2

Another question on Business

Business, 20.06.2019 18:04

You are an aspiring entrepreneur looking at maslow's hierarchy of needs to determine what type of consumer-oriented business you should start. after reviewing the hierarchy, you decide that you want to open a business that caters to the most basic level of human needs as defined by maslow. based on this information, you should:

Answers: 2

Business, 22.06.2019 16:20

The assumptions of the production order quantity model are met in a situation where annual demand is 3650 units, setup cost is $50, holding cost is $12 per unit per year, the daily demand rate is 10 and the daily production rate is 100. the production order quantity for this problem is approximately:

Answers: 1

Business, 22.06.2019 21:20

Which of the following best describes vertical integration? a. produce goods or services previously purchasedb. develop the ability to produce products that complement the original productc. develop the ability to produce the specified good more efficiently than befored. build long term partnerships with a few supplierse. sell products to a supplier or a distributor

Answers: 2

You know the right answer?

Assume that Bunch Inc. has an issue of 18-year $1,000 par value bonds that pay 7% interest, annually...

Questions

History, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31

Physics, 28.01.2020 12:31

English, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31

History, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31

Mathematics, 28.01.2020 12:31