Business, 19.01.2021 19:20 abemorales

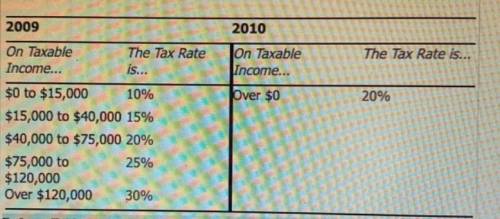

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010

On Taxable The Tax Rate On Taxable The Tax Rate is...

Income... is... Income...

$0 to $15,000 10% Over $0 20%

$15,000 to $40,000 15%

$40,000 to $75,000 20%

$75,000 to 25%

$120,000

Over $120,000 30%

Refer to Table: For an individual who earned $35,000 in taxable income in both years, which of the following describes the change in the individual's marginal tax rate between the two years?

a. The marginal tax rate increased from 2009 to 2010.

b. The marginal tax rate decreased from 2009 to 2010.

c. The marginal tax rate remained constant from 2009 to 2010.

d. The change in the marginal tax rate cannot be determined for the two ta schedules shown.

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

You know the right answer?

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010...

Questions

Business, 06.11.2020 06:30

English, 06.11.2020 06:30

Mathematics, 06.11.2020 06:30

Biology, 06.11.2020 06:30

Mathematics, 06.11.2020 06:30

English, 06.11.2020 06:30

Chemistry, 06.11.2020 06:30

Mathematics, 06.11.2020 06:30

Computers and Technology, 06.11.2020 06:30

Mathematics, 06.11.2020 06:30

Mathematics, 06.11.2020 06:30