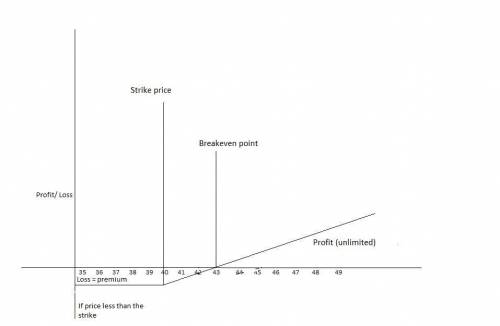

You have purchased one call option expiring in one year with a strike price of $40. The current price of the underlying is $30, the interest rate is zero, and the premium for the call option is $2.63.

1) Draw the payoff and P&L diagrams for the call option at expiration.

2) What is the P&L on the option at expiration if the underlying is $57.50 (i. e. S1 = 57.5)?

Answers: 3

Another question on Business

Business, 22.06.2019 21:40

Which of the following distribution systems offers speed and reliability when emergency supplies are needed overseas? a. railroadsb. airfreightc. truckingd. pipelinese. waterways

Answers: 2

Business, 22.06.2019 22:20

Which of the following best explains why the demand for housing is more flexible than the supply? a. new housing developments are being constructed all the time. b. low interest rates for mortgages make buying a home very affordable. c. the increasing population always drives demand upwards. d. people can move more easily than producers can build new homes.

Answers: 1

Business, 22.06.2019 23:10

Amazon inc. does not currently pay a dividend. analysts expect amazon to commence paying annual dividends in three years. the first dividend is expected to be $2 per share. dividends are expected to grow from that point at an annual rate of 4% in perpetuity. investors expect a 12% return from the stock. what should the price of the stock be today?

Answers: 1

You know the right answer?

You have purchased one call option expiring in one year with a strike price of $40. The current pric...

Questions

Health, 28.09.2019 14:30

Mathematics, 28.09.2019 14:30

Mathematics, 28.09.2019 14:30

Social Studies, 28.09.2019 14:30

Biology, 28.09.2019 14:30

Social Studies, 28.09.2019 14:30

Biology, 28.09.2019 14:30

Mathematics, 28.09.2019 14:30

Social Studies, 28.09.2019 14:30

Mathematics, 28.09.2019 14:30

Mathematics, 28.09.2019 14:30

English, 28.09.2019 14:30

English, 28.09.2019 14:30

English, 28.09.2019 14:30

History, 28.09.2019 14:30