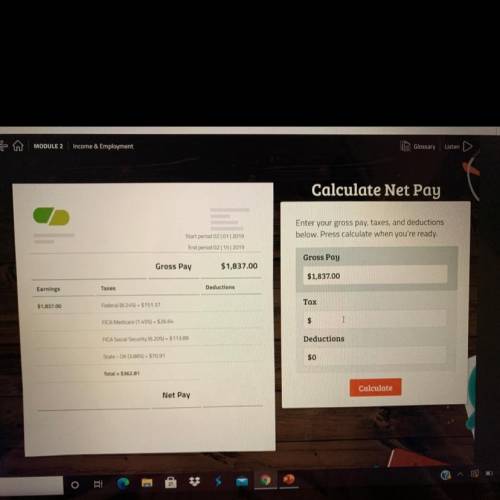

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you...

Business, 27.01.2021 03:40 auviannadority13

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you're ready.

Start period 02/01/2019

End period 02152019

Gross Pay

Gross Pay

$1,837.00

$1,837.00

Earnings

Taxes

Deductions

$1,837.00

Federal (8.24) - $ 151.37

Tax

FICA Medicare (1.451) - $26.64

FICA Social Security (6.20%) - $113.89

Deductions

State - OK (3.86%) - $70.91

$0

Total = $362.81

Net Pay

Calculate

Answers: 1

Another question on Business

Business, 22.06.2019 04:50

Neveready flashlights inc. needs $317,000 to take a cash discount of 3/15, net 70. a banker will loan the money for 55 days at an interest cost of $13,200. a. what is the effective rate on the bank loan? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) b. how much would it cost (in percentage terms) if the firm did not take the cash discount but paid the bill in 70 days instead of 15 days? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) c. should the firm borrow the money to take the discount? no yes d. if the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $317,000? e-1. what would be the effective interest rate in part d if the interest charge for 55 days were $7,200?

Answers: 3

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 11:00

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 22.06.2019 15:20

On january 2, 2018, bering co. disposes of a machine costing $34,100 with accumulated depreciation of $18,369. prepare the entries to record the disposal under each of the following separate assumptions. exercise 8-24a part 2 2. the machine is traded in for a newer machine having a $50,600 cash price. a $16,238 trade-in allowance is received, and the balance is paid in cash. assume the asset exchange has commercial substance.

Answers: 2

You know the right answer?

Questions

Mathematics, 28.09.2020 05:01

History, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Chemistry, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

English, 28.09.2020 05:01

History, 28.09.2020 05:01

Biology, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01

Mathematics, 28.09.2020 05:01